$1 Billion In Crypto Futures Rekt After Bitcoin Rollercoaster

Data shows more than $1 billion in cryptocurrency futures contracts have been liquidated following the rollercoaster Bitcoin has gone through.

Bitcoin Has Seen Wild Price Action Since Setting New All-Time High

During the past 24 hours, Bitcoin has finally managed to achieve a new all-time high beyond the $69,000 level. Unlike what some may have hoped for, though, the break lasted only temporarily, with a crash following soon after.

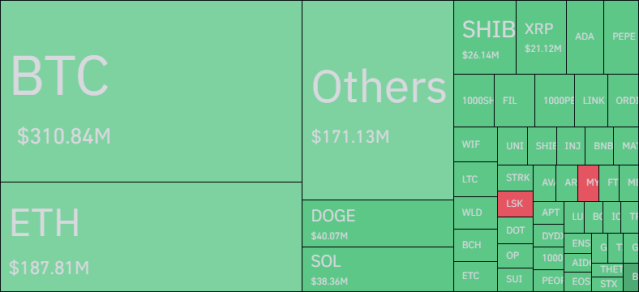

The below chart shows how the price action in the cryptocurrency has looked like recently:

As is visible in the graph, Bitcoin’s latest crash was quite sharp, and during it, the asset’s price even witnessed a very brief venture below the $60,000 level. Since then, though, the cryptocurrency has enjoyed a quick rebound, as it’s now already trading above $67,000.

As is usually the case, the rest of the sector has also observed similar wild price action in the past day. Given this sharp volatility across the sector, it’s not very surprising that the futures market has gone through turmoil during the past day.

Crypto Derivative Market Has Registered A Long Squeeze In The Past Day

According to data from CoinGlass, the cryptocurrency market has witnessed an extremely high amount of liquidations in the last 24 hours. A contract is said to be “liquidated” when the derivative platform with which it’s open forcibly closes it up, due to it accumulating losses of a certain degree.

By nature, the chance of a position being liquidated becomes much higher during volatile periods, especially if the user has opted for a significant amount of leverage (that is, a loan amount borrowed against the initial collateral).

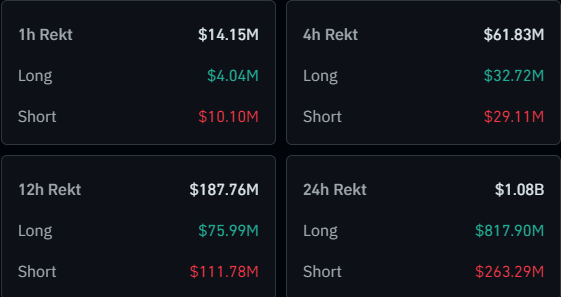

The table below shows the data for the liquidations that have occurred in the sector during the last 24 hours:

It would appear that contracts worth more than a billion have found liquidation in the past day. In the cryptocurrency market, it’s not that rare to see large simultaneous liquidations due to the high volatility of coins seen on the regular, but today’s numbers are high even by the sector’s standards.

This showcases the explosive combination that the cryptocurrency market has had in the last 24 hours, with the presence of both high volatility and wild speculation.

The longs have been dealt the majority of this flush, as more than 75% of the liquidations have involved this type of contracts. Events like this, where a large amount of liquidations occur in a narrow slice of time are popularly called “squeezes.”

In the past day, both a long squeeze and a short squeeze have occurred (due to Bitcoin witnessing a crash and then rebounding back up), but the long squeeze has clearly been much more intense.

In terms of the individual contribution to the liquidation flush from the symbols, Bitcoin and Ethereum combined have accounted for less than half of the total liquidations, suggesting altcoins have been receiving high speculative interest.