Bitcoin ETF Issuer VanEck Dives Into Stablecoin Market, Must-Know Facts Revealed

In a move highlighting the growing interest in the stablecoin market, Nick Van Eck, son of investment management veteran Jan Van Eck, is making a significant bet on cryptocurrencies through the family business.

Agora, a startup co-founded by spot Bitcoin exchange-traded fund (ETF) manager firm VanEck, along with crypto veterans Drake Evans and Joe McGrady, recently raised $12 million in a seed funding round to launch its USD stablecoin.

VanEck-Backed Agora Enters Stablecoin Space

According to a Bloomberg report, Agora’s stablecoin will be backed by cash, US Treasury bills, and overnight repurchase agreements. It will be managed by VanEck, according to Kyle DaCruz, director of digital assets products at VanEck.

DaCruz emphasized the importance of having audited and transparent stablecoin reserves to ensure transparency and trustworthiness. Agora plans to build this future by partnering with crypto companies, including exchanges, custodians, decentralized applications (dApps), and trading firms, rather than directly targeting customers in different regions.

While Tether currently dominates the stablecoin sector, with a market value of around $104 billion, and USDC issued by Circle holds about $32 billion, VanEck believes there is still room for a newcomer.

Per the report, Agora aims to fill this gap by focusing on regions such as Argentina and Southeast Asia, where stablecoins have significantly impacted.

Notably, Agora’s stablecoin will only be available to users outside the United States due to the country’s lack of federal legislation governing stablecoins. VanEck highlighted the importance of regulatory clarity and intended to serve international customers primarily until such legislation is in place.

Agora plans to establish income-sharing contracts with its partners, offering them benefits while individual holders of Agora won’t receive direct yield or income. VanEck also expressed concerns about some projects in the stablecoin sector, particularly in light of the TerraUSD blowup, and emphasized the need to build a company that positively advances the industry.

Bitcoin ETF Trading Volume Skyrockets To $111 Billion

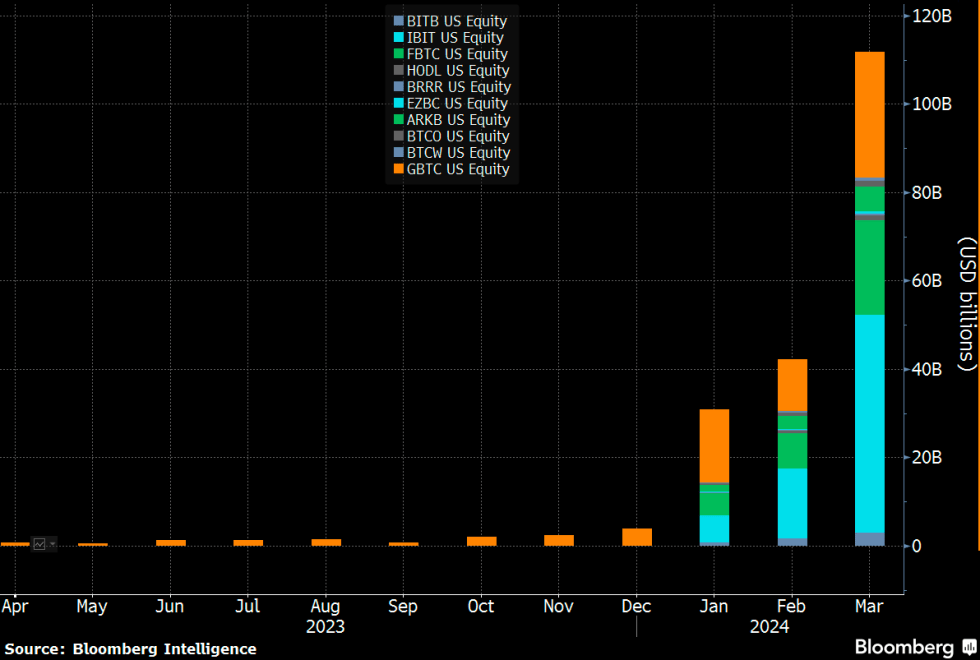

In a significant increase in interest in the newly approved investment vehicles, spot Bitcoin ETFs traded $111 billion in March, nearly tripling February’s total of $42.2 billion.

Bloomberg ETF expert Eric Balchunas took to social media site X (formerly Twitter) and highlighted the significance of this milestone, underlining the substantial growth in trading volume by stating:

Bitcoin ETFs traded $111 billion in March, which is just about triple what they did in February and January. I can’t imagine April will be bigger, but who knows.

Among the spot ETFs available, those issued by Grayscale (GBTC), BlackRock (IBIT), and Fidelity (FBTC) continued to dominate trading volume, as seen in the chart above shared by Eric Balchunas. However, Grayscale’s GBTC fund has experienced total outflows of more than $15 billion since it began trading in January.

The significant growth in spot Bitcoin ETF trading volume reflects the increasing demand for crypto investment products. As more investors seek exposure to the digital asset market through regulated and easily accessible vehicles, ETFs have gained traction as a popular option.

At present, the largest cryptocurrency in the market, BTC, is being traded at $65,200, reflecting a significant decline of over 4% within the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com