Official launch of Liquid, a new crypto platform opening up liquidity for crypto markets worldwide

– Liquid accessibility to bolster sector-wide liquidity –

TOKYO, Japan, 7th September 2018 – Global fintech company Quoine has unveiled Liquid, a cryptocurrency one-stop trading portal, which will allow users to access a worldwide network of cryptocurrency exchanges.

At launch, Liquid allows users to match trades across multiple transactions and cryptocurrencies. For example, the orders of BTC/SGD, ETH/SGD and BTC/ETH can be matched together. This is expected to greatly increase the liquidity of all available cryptocurrencies on Liquid.

In subsequent stages, Liquid will offer a World Book technology that aggregates the orders and prices on various exchanges into a single highly liquid and tradable order book and allows orders to be placed in the currency of one’s choice.

A fragmented trading landscape and lack of liquidity have hampered the development of the cryptocurrency markets. Liquid will facilitate market stability, enhance liquidity and empower a new wave of digital asset traders to buy and sell tokens safely.

Quoine is the first global cryptocurrency exchange to be officially licensed by the Japan Financial Service Authority (FSA) for its Japanese operations. Moreover, Quoine’s existing trading platforms, Qryptos and Quoinex, are among the most advanced in the world. The existing digital currency exchange and trading platforms will merge into the new Liquid portal, providing access to liquidity pools sourced by a unified platform.

Currently, Quoine processes annual transactions worth over $50 billion and are amongst the top crypto-exchanges in the world[1]. In November 2017, Quoine successfully raised USD105M in an oversubscribed ICO, to fund the growth of the Liquid platform.

A fragmented and non-liquid crypto economy

Crypto exchanges offer an overlapping variety of cryptocurrency pairs. However, the fragmented trading landscape has led to price and volume discrepancies, creating individual currency silos, with greater liquidity on one exchange not reflected on the other. As liquidity and the best price constantly shifts from exchange to exchange around the world, it creates substantial price volatility and accessibility issues for traders.

“Cryptocurrency markets need stability. This year, the 30 day BTC/USD volatility [2] index has been above 3% for almost the entire year, with highs topping 8% at the start of the year. Liquid is paving the way to a less volatile future by improving liquidity within the cryptocurrency ecosystem,” said Mike Kayamori, Co-Founder and CEO of Quoine.

“However, Liquid is more than just a cryptocurrency exchange. Liquid is an all-in-one platform that will bridge the gap between traditional finance and the token economy. We offer everything you need within our suite of services, while our underlying tech will help connect a global crypto community.”

Introducing Liquid Platform

Liquid’s World Book will provide liquidity with its matching engine technology, which matches orders to ensure traders can always buy and sell into healthy order books.

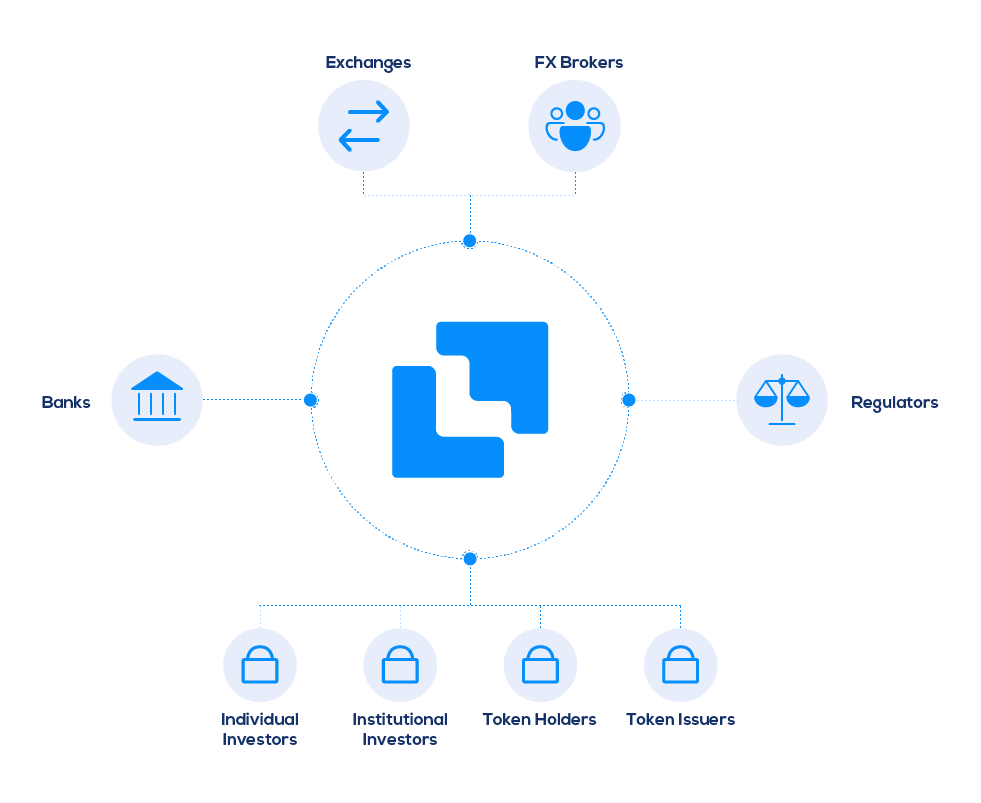

Figure 1: Liquid Platform

Liquid’s World Book comprises an internal and external book:

Internal Order Book: At launch, the order book contains FX-adjusted orders for all orders placed by users internally within Liquid platform.

External Aggregated Order Book: Moving forward, the external order book will eventually contain all other orders (but FX adjusted) that exist throughout the world other than those placed in Internal Order Book. Each order in this book is linked to an order on the various exchanges internationally.

The World Book is driven by three technologies that have been utilised extensively by Quoine daily, powering the existing QUOINEX and QRYPTOS trading platforms and cryptocurrency exchanges:

- Matching Engine (ME): The engine is capable of processing several million transactions per second, making it one of the most advanced matching engines in the industry.

- Cross Currency Conversion Engine (CCCE): The CCCE allows for near-instant, automated currency conversions between cross currency pairs.

- Smart Order Routing (SOR): The technology maintains low-latency, real-time (R/T) feeds for all major exchanges throughout the world.

In the first phase of the launch, Liquid is introducing new and refined features such as:

- Internal Order Book that will enable the matching of orders across orders books with different trading pairs

- Upgraded Matching Engine that processes up to several millions of transactions per second

- Improved User Interface (UI) which includes a Markets page allowing users to explore spot markets

- Advanced Features allowing users to execute iceberg orders

- Advanced Margin Trading allowing users to view unrealised penalties

- Lending feature allowing hodlers to earn interest on their crypto assets

- ICO Market 2.0 allowing users to access ICO token sales, private sales, and project analyses

Quoine will continue to roll out the following features in progressive phases:

- External Aggregated Order Book that can aggregate the orders and prices on the world’s various exchanges into a single highly liquid and tradable order book

- New KYC process enabling withdrawals under certain limits to be done without KYC

- Use of credit card to fund accounts

- Quick deposit/withdrawals of funds

- Mobile app on Google and Apple app store

Fuelling the platform will be a utility token called the QASH token, which grants access to the full suite of services on Liquid, along with discounts and additional benefits.

“Quoine aims to provide liquidity to the non-liquid crypto economy. With the launch of Liquid, Quoine is building a solid, global financial utility. An advanced platform the entire crypto economy will use to great advantage; where anyone can participate as users and token holders,” said Mario Gomez Lozada, Co-Founder, President and Chief Product Officer of Quoine.

###

ABOUT QUOINE

Quoine is a leading global fintech company that provides trading, exchange, and next generation financial services powered by blockchain technology. With offices in Japan, Singapore and Vietnam, Quoine combines a strong network of local partners with extensive team experience in banking and financial products to deliver best in class financial services for its customers. More information is available at www.quoine.com

In 2014, Quoine launched Quoine Exchange, later known as Quoinex, which became one of the largest bitcoin exchanges in the world by transaction volume.

In June 2017, Quoine launched a cryptocurrency-only exchange and trading platform called Qryptos, exclusively for cryptocurrency trading. Both Quoinex and Qryptos offer powerful trading features, a sophisticated user dashboard, secure cold wallet storage and KYC compliance for individual and corporate customers.

In September 2017, Quoine Corporation became the first global cryptocurrency exchange to be officially licensed by the Japan Financial Services Agency for its Japanese operations.

In October 2017, Quoine became the first licensed global cryptocurrency exchange in Japan to launch a global Initial Coin Offering (ICO), also known as the QASHToken Sale.

In November 2017, Quoine successfully raised 350m QASH(the equivalent of 350K ETH or ~USD105m) in an oversubscribed ICO, to fund the growth of the Liquid platform. As part of the Liquid platform development, Quoinex and Qryptos will be merged into Liquid.

As at July 2018, both Quoinex and Qryptos exceeded USD50 billion in combined transaction volumes in the past 12 months.

In September 2018, Quoinex and Qryptos was merged and relaunched as Liquid. Liquid is powered by Quoine’s World Book, which provides customers enhanced price matching and deeper liquidity for various fiat and cryptocurrency pairs. More information can be found at: https://liquid.com

MEDIA CONTACT DETAILS

Quoine Contact Person: Renee Tng

Email: [email protected]

Corporate Website: https://quoine.com

Liquid Website: https://liquid.com

Telegram Community: https://t.me/Quoine

Red Flag Contact Person

[1] According to CoinmarketCap rankings

[2] According to buybitcoinworldwide,com

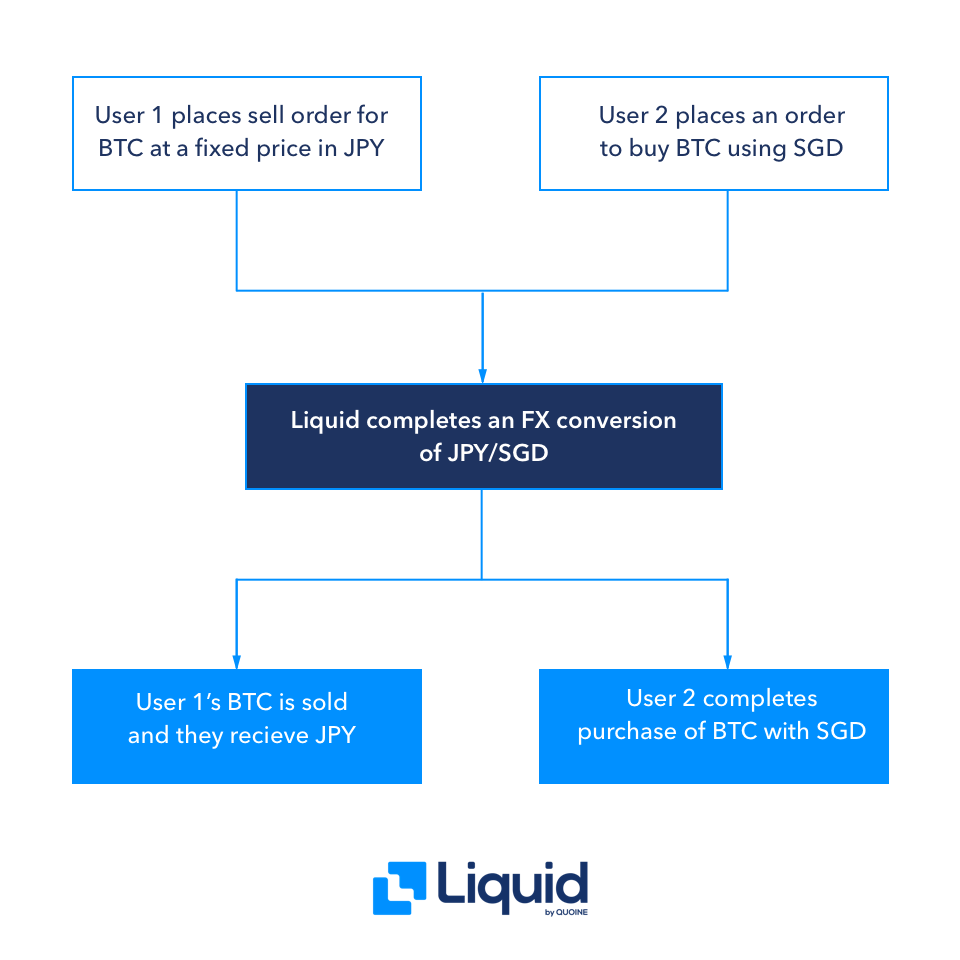

The Internal Order Book completes an FX conversion of JPY/SGD in order to match a trade of different trading pairs within the Liquid platform.

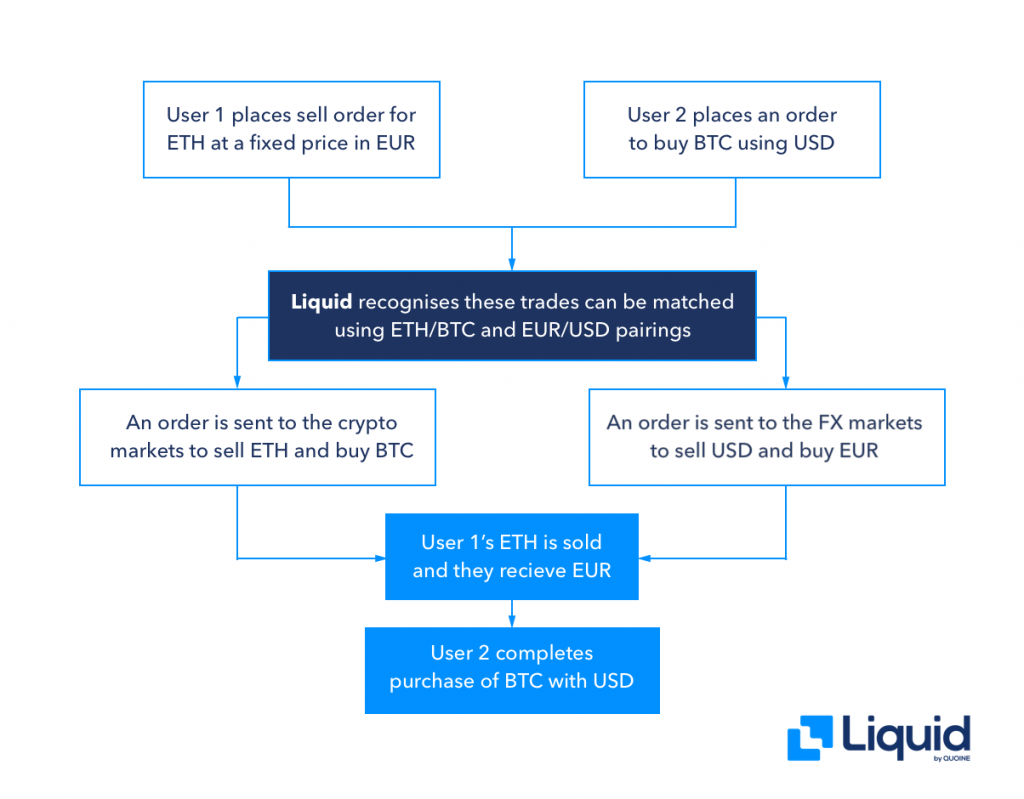

The matching engine within the External Aggregate Order Book allows a trade of ETH/EUR to be matched with a trade of BTC/USD.

This is a sponsored press release and does not necessarily reflect the opinions or views held by any employees of NullTX. This is not investment, trading, or gambling advice. Always conduct your own independent research.

The post Official launch of Liquid, a new crypto platform opening up liquidity for crypto markets worldwide appeared first on NullTX.