Bitcoin Emerges as ‘Flight to Safety’ Asset, Outshining Gold, Says Cathie Wood

ARK Invest’s CEO Cathie Wood believes there is a shift in investment trends, specifically, a growing preference for bitcoin over traditional gold investments. This trend has been particularly pronounced following the launch of spot bitcoin ETFs, offering investors streamlined access to the cryptocurrency.

Cathie Wood Says Investors Are Shifting From Gold to Bitcoin Amid Financial Uncertainty

In a recent video on ARK Invest’s Youtube channel, CEO Cathie Wood said there is a significant shift among investors moving from traditional gold investments to bitcoin. This shift, according to Wood, has become increasingly apparent following the introduction of spot bitcoin exchange-traded funds (ETFs), providing a less cumbersome access to the cryptocurrency.

During a dialogue with Brett Winton, ARK’s chief futurist, Wood pointed to bitcoin’s remarkable resilience and growth, especially in times of financial instability. She recalled the instance of March 2023, when the U.S. faced a regional bank crisis, leading to a 40% surge in bitcoin’s value as the regional bank index plummeted. “Bitcoin shot up 40% as the KRE, the regional bank index, was imploding. And here again, the regional bank index is acting up, and we are seeing Bitcoin catch a bid again,” Wood stated, underscoring bitcoin’s emerging role as a “flight to safety” asset.

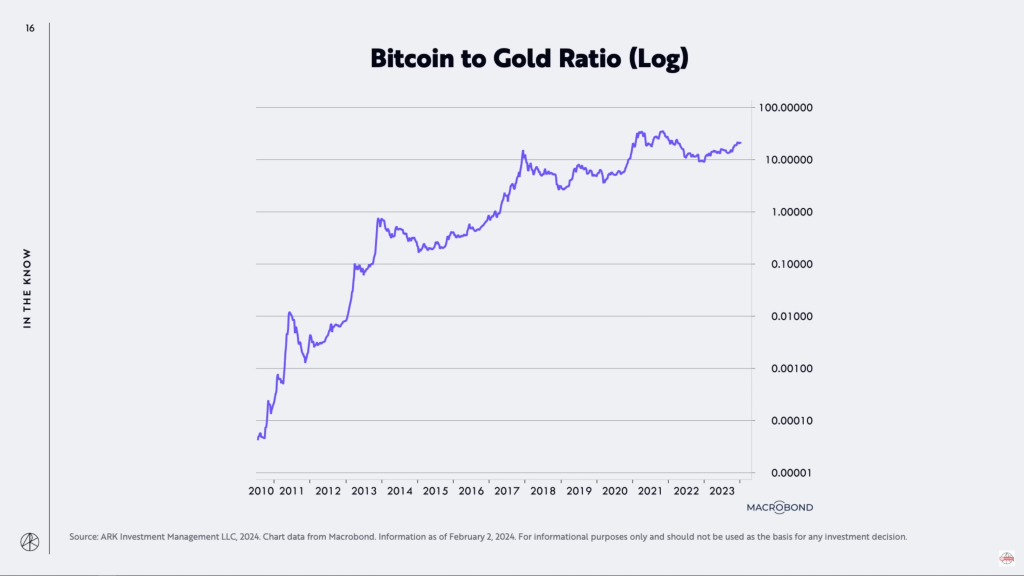

Wood shared a compelling chart illustrating bitcoin’s price in gold, showcasing a strong, long-term uptrend. This trend, she explained, signifies bitcoin’s ongoing process of partially replacing gold as a preferred investment choice. “This chart just shows you that even relative to gold, Bitcoin has been rising. There’s now a substitution into Bitcoin, and we think that is going to continue,” she remarked.

Addressing the volatility following the launch of spot bitcoin ETFs, including ARK 21shares Bitcoin ETF on January 11, Wood explained that the subsequent price correction was anticipated. Despite a 20% drop in bitcoin’s price post-launch, Wood remains optimistic, citing that 15 million of the 19.5 million bitcoin currently in circulation have not moved in over 155 days, suggesting a strong holding pattern among investors.

ARK Invest’s strategic movements in the cryptocurrency space extend beyond bitcoin. The firm has significantly invested in Coinbase stock (COIN), although it has scaled back its holdings since June 2023. As of now, ARK holds 7.187 million shares in Coinbase, valued at $843 million, reflecting its continued bullish stance on the crypto sector despite market fluctuations.

Do you agree with Woods that investors who usually would seek gold as an investment are beginning to shift to bitcoin? Share your thoughts and opinions about this subject in the comments section below.