Bitcoin ETF Contradiction: JPMorgan CEO Slams BTC Despite Bank’s Key Position In BlackRock’s ETF

In a recent interview with CNBC’s Squawk Box, JPMorgan CEO Jamie Dimon has once again expressed his skepticism towards Bitcoin, the largest cryptocurrency in the market. This new wave of criticism comes despite JPMorgan’s involvement as an authorized participant (AP) for BlackRock’s Bitcoin ETF.

JPMorgan CEO Calls Bitcoin A “Pet Rock”

During the interview, Dimon acknowledged the potential of blockchain technology, describing it as efficient and capable of moving money and data. However, Dimon distinguished cryptocurrencies, stating that some possess tangible use cases while others, such as Bitcoin, do not.

Dimon likened Bitcoin to a “pet rock,” suggesting it lacks practical value beyond being a speculative asset. JPMorgan CEO stated:

There are cryptocurrencies that do something that might have value. And then there’s one that does nothing, I call it pet rock. The Bitcoin, or something like that

The JPMorgan CEO emphasized that certain cryptocurrencies can facilitate real-world applications, such as small smart contracts for buying and selling real estate or tokenizing assets.

However, Dimon also pointed out the negative aspects associated with Bitcoin, including its use in illicit activities like money laundering, tax evasion, fraud, and sex trafficking. Dimon cited instances where Bitcoin had been employed for such purposes, involving transactions worth hundreds of millions of dollars.

It is noteworthy that JPMorgan Securities has been named an authorized participant for BlackRock’s proposed Bitcoin ETF alongside Jane Street Capital.

This raises a paradoxical situation wherein Dimon, the bank’s CEO, criticizes Bitcoin while the institution actively engages with Bitcoin-related initiatives. The contrasting narratives within JPMorgan indicate a complex internal perspective regarding digital assets.

Dimon’s statements align with his previous remarks, reiterating his belief that Bitcoin lacks intrinsic value. However, the cryptocurrency community argues that Bitcoin’s decentralized nature and potential as a store of value make it an attractive asset class.

Bitcoin ETFs Make A Splash With Nearly $10 Billion Traded

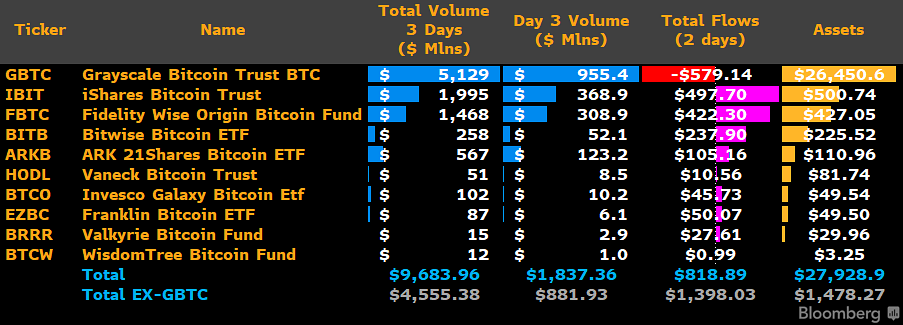

Since the commencement of Bitcoin ETF trading on January 11th, the market has witnessed significant trading volume across the 11 different ETFs. ETF experts James Seyffart and Eric Balchunas from Bloomberg have noted the substantial success of these launches, with nearly $10 billion traded in just three days.

According to Seyffart, the trading volume generated by the Bitcoin ETFs within the first three days is a testament to their success. The collective trading volume of nearly $10 billion demonstrates investor interest and confidence in these products.

Balchunas contextualizes the impressive $10 billion trading volume by comparing it to the performance of different ETFs launched in 2023.

Despite having months to gain momentum, the combined trading volume of 500 ETFs launched in 2023 amounted to only $450 million, with the best-performing ETF achieving $45 million.

In contrast, the Bitcoin ETFs have surpassed the entire trading volume of the ’23 Freshman Class, underscoring the exceptional interest and demand for these products, according to Balchunas.

Balchunas further explains the difficulty in generating substantial trading volume for ETFs. While marketing efforts and investor inflows can influence flows and asset growth, trading volume must naturally develop within the marketplace.

This natural formation of trading activity ensures the authenticity and liquidity of the ETF, enhancing its staying power and attractiveness to investors. The fact that the Bitcoin ETFs have already garnered significant trading volume within a short period indicates their potential to maintain long-term market presence.

Featured image from Shutterstock, chart from TradingView.com