Bitcoin Inflows To Binance Spike: Whales Starting 2024 With Selloff?

On-chain data shows the Bitcoin inflows to cryptocurrency exchange Binance have shot up, a sign that whale selling may be happening.

Bitcoin Netflow To Binance Has Been Highly Positive During Past Day

CryptoQuant Netherlands community manager Maartunn explained in a new post on X that the exchange reserve on Binance has registered a sharp increase during the past day.

The indicator of interest here is the “exchange netflow,” which keeps track of the net amount of Bitcoin entering into or exiting the wallets of any given centralized exchange. The metric’s value is calculated by subtracting the outflows from the inflows.

When the indicator has a positive value, the inflows overwhelm the outflows, and the platform is receiving transfers of a net number of coins right now. As one of the main reasons investors would want to deposit to the exchanges is for selling purposes, this trend can have bearish implications for the cryptocurrency’s price.

On the other hand, the negative indicator implies net withdrawals are taking place currently, which may be a sign that the holders are accumulating. Naturally, such a trend can prove to be bullish for the price in the long term.

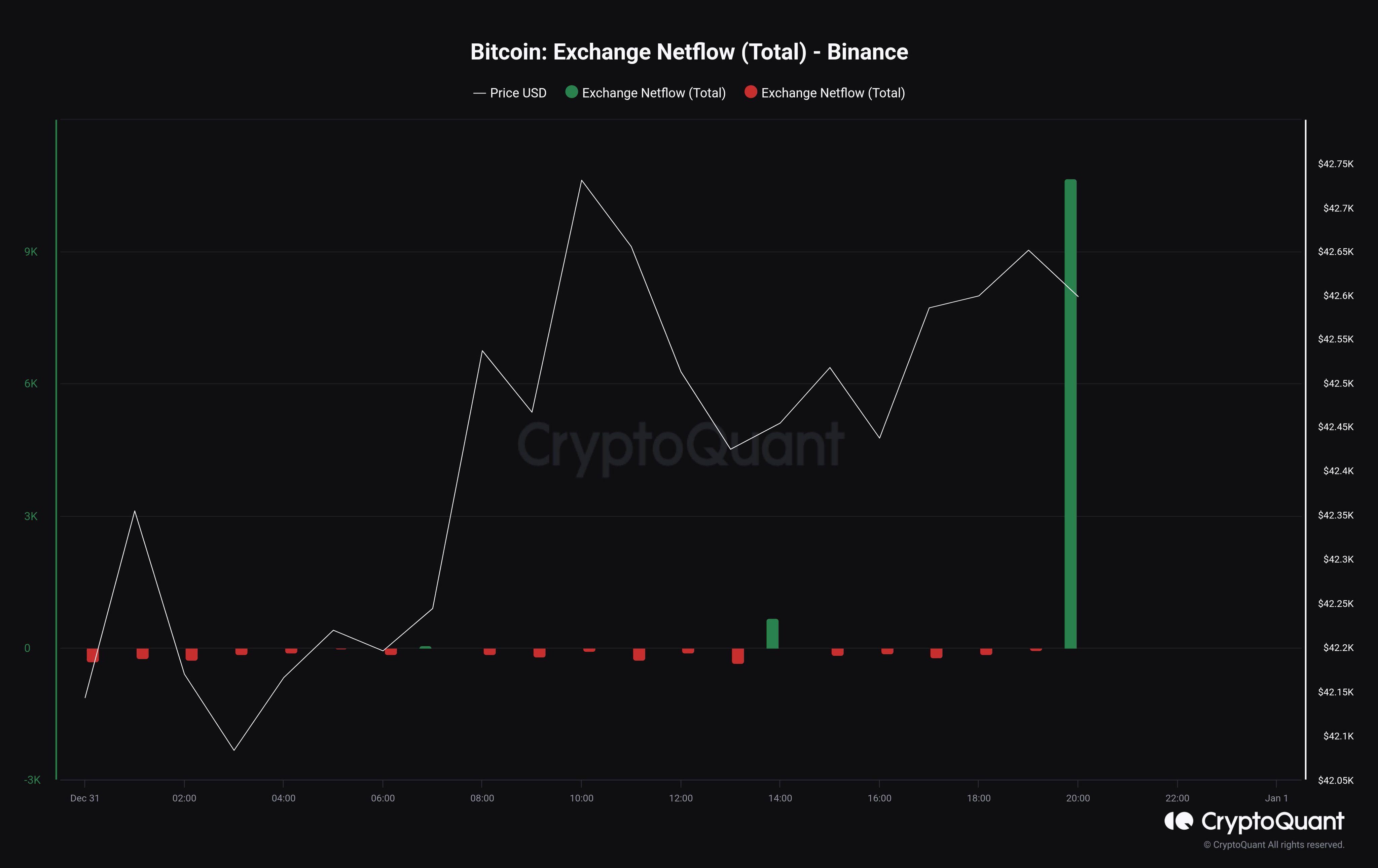

Now, here is a chart that shows the trend in the Bitcoin exchange netflow specifically for the cryptocurrency exchange Binance:

As displayed in the above graph, the Bitcoin exchange netflow for Binance has observed a large positive spike recently. This would suggest that the platform has witnessed net deposits from the investors.

In total, 10,666 BTC has made its way to the platform during this latest netflow spike, worth a whopping $454.6 million at the current spot price of the cryptocurrency.

It would appear that some whales are potentially looking to offload a large sum of coins. If their intention is indeed selling here, then Bitcoin could feel a negative impact.

So far, though, the asset’s price hasn’t shown any notable move since the whales have made these net inflows to Binance. However, this doesn’t completely rule out a selloff, as sometimes these humongous holders make deposits in advance and sell a bit later once they find the right opportunity.

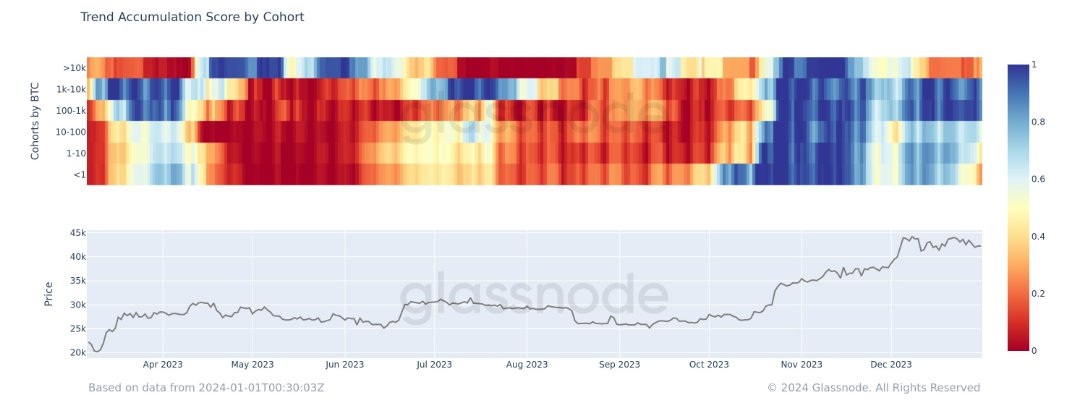

Analyst James V. Straten has shared a Glassnode chart in an X post that breaks down the market’s accumulation and distribution trends among the different investor groups.

While some of the cohorts are buying, including the whales (1,000 BTC to 10,000 BTC), the largest of the hands in the market (more than 10,000 BTC, the “mega whales“) are distributing currently. This indicator would also thus provide hints that humongous entities are currently making selling moves.

BTC Price

At the time of writing, Bitcoin is trading at around $42,700, down 2% in the past week.