Crypto Hub: Chainalysis Highlights North America As The Ultimate Market

The crypto market remains a hotbed of activity amidst regulatory uncertainties and evolving market dynamics. Despite recent fluctuations and the complex regulatory landscape, North America continues to hold its ground as a dominant player in the global digital currency market, albeit with some nuanced changes.

Amidst the seemingly turbulent atmosphere of regulatory uncertainties and oscillating sentiments in the digital asset sector, North America stands as a resilient stronghold of the global cryptocurrency market. The region managed to seize a significant chunk of global digital asset transactions, showcasing its prominence as a key player in the ever-evolving landscape.

A recent Chainalysis report highlighted North America’s notable position, securing 24.4% of the on-chain transaction value between July 2022 and June 2023, translating to a substantial $1.2 trillion in crypto transactions.

Of this staggering sum, over $1 trillion originated from the United States alone, underscoring the nation’s pivotal role in driving the region’s digital currency activities.

Decline In DeFi Dominance And Regulatory Uncertainty

However, despite this seemingly robust performance, the region has witnessed a noticeable decline in its share of Decentralized Finance (DeFi) activities over the last year. Historically recognized as an enthusiastic adopter of DeFi, North America’s diminishing share suggests a shift in market dynamics and preferences.

Chainalysis pointed out that several DeFi platforms are specializing in speculative trading, often creating assets that are more susceptible to market downturns. Such factors have contributed to the decreasing popularity of DeFi among investors, casting a shadow over the region’s previous dominance in this domain.

Moreover, regulatory uncertainties within the US market have further compounded the challenges faced by the North American crypto sector. The lack of a comprehensive regulatory framework has led to a climate of ambiguity, deterring some investors and businesses from fully embracing the potential of the digital asset market.

As a result, the decline in crypto activities within North America, reflecting a global trend, underscores the critical role that regulatory clarity plays in fostering sustained growth and development within the sector.

North America’s Resilience And Crypto Prospects

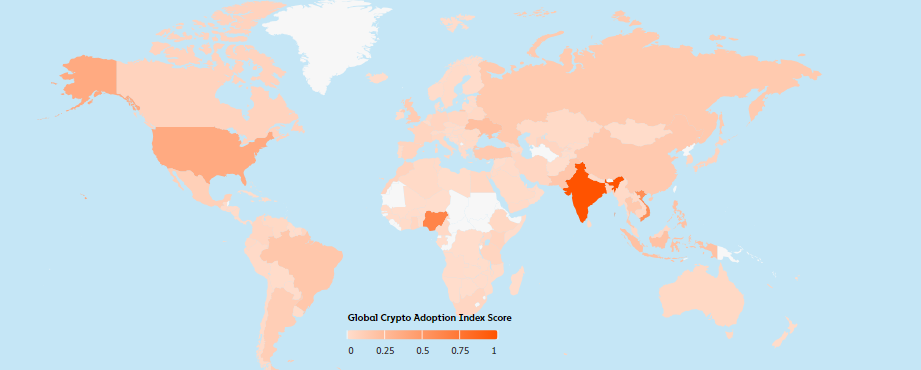

Despite the challenges, North America has managed to secure a commendable fourth position in the 2023 Global Crypto Adoption Index, signaling its enduring resilience and potential for recovery. As the region looks to rebound from the recent crypto winter, the role of regulatory frameworks in facilitating a conducive environment for growth becomes increasingly critical.

The ongoing race for a Bitcoin Exchange-Traded Fund (ETF) has further highlighted the significance of institutional participation in cementing North America, especially the United States, as a focal point for crypto activities.

However, the regulatory journey is not without its hurdles. Regulatory delays, as evidenced by the US Securities and Exchange Commission’s repeated postponements of applications from major institutions like BlackRock and Ark Invest, continue to underscore the complexities associated with establishing a comprehensive regulatory framework for digital assets.

Despite this, assets such as Bitcoin (BTC), Ether (ETH), and others are still overshadowed by the pervasive influence of stablecoins, which retain their position as the most widely-used crypto asset, further shaping the trajectory of the North American crypto market.

Featured image from Finance Magnates