Congressional Investments in Defense Stocks Raise Ethical Eyebrows Amidst Ongoing Wars

In the midst of ongoing strife in Ukraine and Israel, stocks of publicly listed defense corporations have seen a dramatic surge. Simultaneously, U.S. government officials have backed substantial war expenditures, and reports indicate a multitude of politicians reaping financial benefits from investments in defense companies such as Palantir, L3Harris, Lockheed Martin, and Northrop Grumman.

Legislators’ Stakes in Defense Giants Under Critical Lens Amid Global Conflicts

Since February 24, 2022, the Biden administration has stood by Ukraine amidst its clash with Russia, with approximately $75 billion allocated to aid Ukraine’s military endeavors. Recent tensions between Hamas and Israel have further escalated the situation, with numerous U.S. politicians advocating for military action. Consequently, the stock prices of publicly listed defense corporations have soared, surpassing most Wall Street equities. For instance, Lockheed Martin’s (NYSE: LMT) stock has seen a 3.8% increase over the last 30 days.

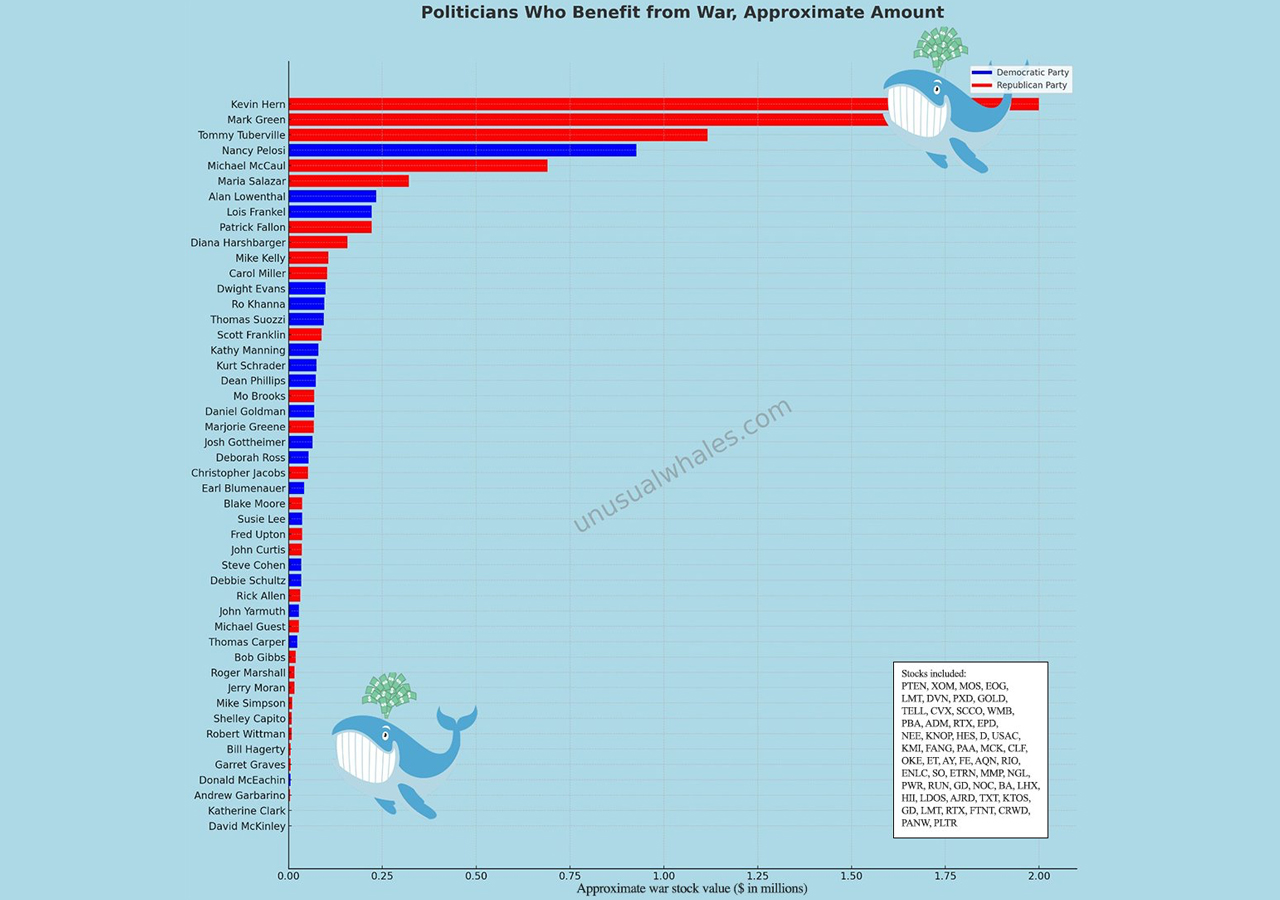

Northrop Grumman (NYSE: NOC) has experienced an over 13% rise, Palantir (NYSE: PLTR) has seen a 10% spike, and L3Harris (NYSE: LHX) has grown 4.4% against the U.S. dollar in the past month. On the social media platform X (previously known as Twitter), an account named “Unusual Whales” has been shedding light on the U.S. officials investing in defense corporations amidst the dual conflicts.

“Just in, another U.S. Congressman has ONCE AGAIN bought war stocks before the Israel and Palestine conflict,” Whales posted. “Representative Josh Gottheimer purchased up to $15,000 of Northrop Grumman Corp, NOC, on Sept. 26, 2023. He sits on the National Security Agency and Intelligence Committees,” the account added. The X account has further revealed a long list of politicians, spanning both Democratic and Republican parties, who have invested millions in defense corporation stocks.

The NOC purchase by Gottheimer can be tracked on quiverquant.com, alongside other U.S. policymakers who hold significant investments in Wall Street, particularly in defense corporation shares. Other NOC investors include Democratic Congressman Daniel Goldman and Democratic Congresswoman Kathie Manning. Lockheed Martin shares are held by Republican Congressman Kevin Hern, who recently bought shares of RTX (Raytheon) on September 7, 2023. Senate Republican Markwayne Mullin also invested between $15K to $50K in RTX the following week.

Even prior to the Israel-Hamas confrontation, the Ukraine-Russia conflict saw a significant number of U.S. politicians profiting from investments in defense corporations. The issue with policymakers investing in defense stocks lies in the fact that defense corporations often allocate substantial resources for lobbying. These companies engage in lobbying activities to sway Congress and other U.S. government sectors. Their lobbying goals range from securing defense contracts, shaping defense policy, to ensuring the persistence of high military spending.

Many believe that there’s a glaring conflict of interest in U.S. politicians investing in defense stocks while backing several wars. Anti-war activists insist it poses a moral quandary. To activists, it is unsettling that the very individuals entrusted with the nation’s welfare are profiting from the escalation of war and violence. This murky intertwining of war politics and personal gain threatens the ethical underpinning of any type of governance, casting a dark shadow on the integrity of political decision-making.

What do you think about the U.S. politicians profiting from war stocks? Share your thoughts and opinions about this subject in the comments section below.