With Bitcoin’s Fourth Halving Under 200 Days Out, What’s at Stake for Miners?

With fewer than 200 days to go, anticipation mounts for the halving, a four-year event that halves the supply rate. Bitcoin’s fourth halving is projected to take place on or around April 24, 2024. This comprehensive guide will help you understand the halving’s effects and what to anticipate.

The Countdown to Halving and Understanding the Halving Mechanism

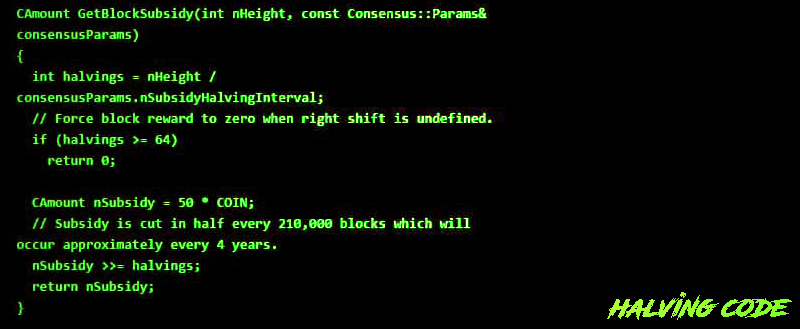

By current measurements, 193 days remain until the halving, set for April 2024. In essence, the Bitcoin halving, coded into Bitcoin by its founder, Satoshi Nakamoto, happens every 210,000 blocks, roughly every four years. When the network hits a certain block number, the mining reward — the bitcoin amount miners earn for verifying transactions — is halved.

For instance, the initial mining reward was 50 bitcoins per block, and it fell to 25 bitcoins per block after 2012’s first halving. This system ensures a regulated supply rate that diminishes over time. To date, Bitcoin has undergone three halvings: the first on November 28, 2012, the second on July 9, 2016, and the third on May 11, 2020, when the reward declined to 6.25 BTC.

The upcoming reduction will slash the reward from 6.25 BTC to 3.125 BTC per block. This halving will decrease the inflation rate from 1.7% annually to 0.84%. Given current prices and the existing 900 BTC issued daily, miners earn about $24 million daily in new bitcoins. If bitcoin’s price stays steady, that daily revenue would fall to $12 million, though many expect the value to significantly increase by then. Historically, bitcoin’s market price has risen before each halving.

Market Response and Miner Profitability

In the months before the 2012 halving, bitcoin’s price jumped from below $5 to over $13, ensuring miner profitability despite a reduced block reward. Similarly, ahead of the 2016 halving, price rose from roughly $400 to more than $600 by July 2016. By December 2016, it surpassed $900. Prices also increased in 2020, particularly later in the year. While each halving tightens miners’ profit margins, price surges have kept them ahead of the game.

The Future and Miner Sustainability

Although prices rose during the past three halvings, it’s not guaranteed. If bitcoin’s price doesn’t climb around halving times, miners face serious profitability risks. Each halving reduces miners’ block reward income by half. If the price remains flat or drops, mining could become unprofitable, potentially forcing many miners to cease operations, consequently diminishing the network’s hashrate and overall security.

Moreover, a concentration of mining power could challenge the network’s decentralization. But if bitcoin’s value rises sufficiently to balance the block reward cut, miners can stay profitable and support the network seamlessly. Miners might also profit from transaction fees, provided there’s significant growth in bitcoin’s use and adoption.

For instance, if four billion individuals each conducted a bitcoin transaction daily, with each transaction incurring a $0.01 fee, that would total $40 million in daily fees. Such a scenario could support miners even after block rewards vanish. While a rising bitcoin price is vital for maintaining miner incentives during halvings, an uptick in user engagement and transaction volume can also allow miners to benefit from onchain fees on a large scale. The halving is a key test of bitcoin’s security and value proposition as an asset.

While the bitcoin protocol’s coded halvings allow estimates of dates and supply inflation, the future remains unpredictable. No one can foretell bitcoin’s price or mining economics at future halvings. The network’s reactions to tightening supply are entirely theoretical until halvings actually occur.

What do you think about the upcoming reward halving? Share your thoughts and opinions about this subject in the comments section below.