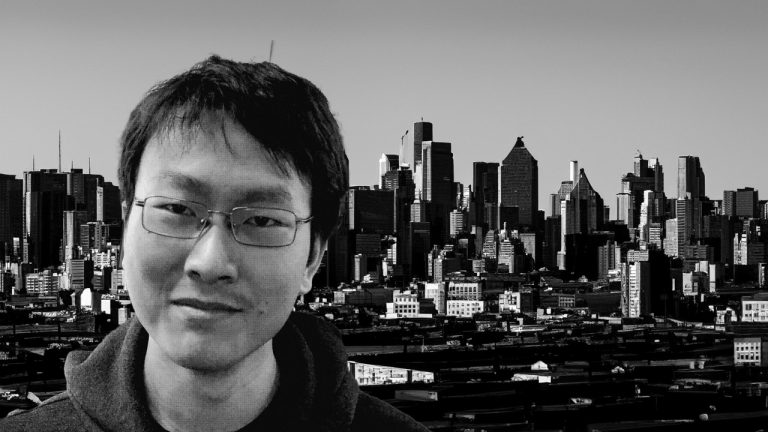

Billionaire on Paper: FTX CTO Gary Wang Reveals Alameda’s Privileges Amidst Exchange Scandal

Former FTX chief technology officer Gary Wang took the stand on Thursday in the trial of FTX founder Sam Bankman-Fried. Wang admitted to committing financial crimes with Bankman-Fried, former Alameda CEO Caroline Ellison, and former FTX engineering executive Nishad Singh.

From High School to Scandal: The Unraveling Ties of FTX’s Wang and Bankman-Fried

Zixiao (Gary) Wang testified that they allowed FTX sister company Alameda Research to withdraw unlimited funds from the exchange. He said these special privileges for Alameda were coded into FTX’s systems. The testimony was published on the social media platform X by Matthew Russell Lee from Inner City Press.

Wang has known Sam Bankman-Fried since high school, when they met at a summer camp in Minnesota. After college, Wang worked at Google before joining Bankman-Fried at cryptocurrency trading firm Alameda Research. When asked about the wire fraud, Wang stated:

We allowed Alameda to withdraw unlimited funds.

Wang explained that Alameda was named after Alameda County in California where it was founded. It included “Research” in the name because Bankman-Fried said it would make opening a bank account easier. Wang owned 10% of Alameda, with Bankman-Fried owning the remaining 90%.

At FTX, Wang focused on coding while Bankman-Fried handled speaking to media, lobbying, and communicating with investors, according to Russell Lee’s X thread. Wang reported directly to Bankman-Fried, who had the final say in any disagreements.

Wang earned a $200,000 salary at FTX but also owned 17% of the company’s stock, making him a billionaire on paper before FTX’s collapse. Prosecutors presented evidence showing Wang and Bankman-Fried’s long-standing relationship and Wang’s integral role at FTX where he enabled Alameda’s special privileges.

Wang’s remarks came on the heels of Adam Yedidia’s testimony. As the proceedings unfold, Bankman-Fried’s attorneys are gearing up for a rigorous cross-examination of the CTO. It was highlighted during the hearing that Wang allocated funds for a home purchase and has a substantial reserve, potentially earmarked for future ventures and startups.

The prosecution further punctuated their case by presenting select photographs and playing a podcast snippet that delves into the origins of Alameda Research’s moniker. The hearing on Thursday with Wang mostly covered his relationship with Bankman-Fried and the alleged wire fraud.

What do you think about Gary Wang’s testimony against Sam Bankman-Fried? Share your thoughts and opinions about this subject in the comments section below.