83.7% Of Bitcoin Short-Term Holders Are Now In Loss: Glassnode

On-chain data from Glassnode suggests that 83.7% of the Bitcoin short-term holder supply is currently being held at an unrealized loss.

Bitcoin Short-Term Holder Supply Has Plummeted Into Losses

According to the latest weekly report from Glassnode, only 16.3% of the short-term holder supply is in profit right now. The relevant indicator here is the “percent supply in profit,” which measures the percentage of the total circulating Bitcoin supply carrying some gains.

This metric works by going through the on-chain history of each coin in circulation to see what price it was last moved/transferred at. If this previous selling price was less than the current spot price, then that particular coin currently carries a profit.

The counterpart indicator to the supply in profit is the “supply in loss,” which naturally keeps track of the opposite type of coins. This metric’s value can also be obtained by subtracting the supply in profit from 100 (since the total percentage must add up to 100%).

While this indicator is for the entire supply, it can also used on only parts of it. In the context of the current discussion, the segment of the supply held by the “short-term holders” (STHs) is of particular relevance.

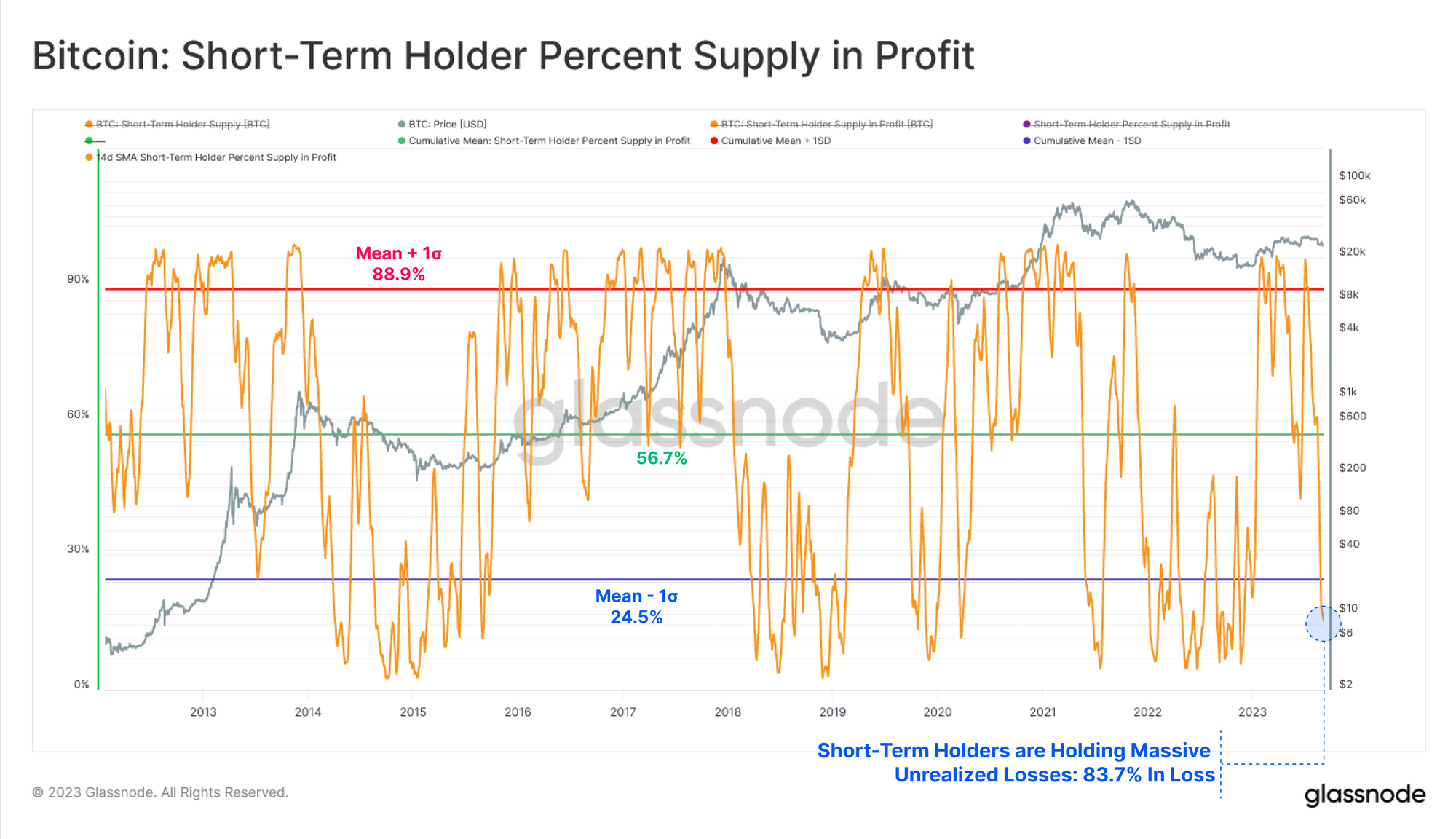

Here is a chart that shows the trend in the percent supply in profit for this cohort over the history of the cryptocurrency:

The STHs are all investors who have been holding onto their coins since less than 155 days ago. The graph shows that the percent supply in profit owned by this cohort has observed a steep plunge recently.

Currently, only 16.3% of the STH supply carries some unrealized profit, or 83.7% is holding a loss. The dire state these holders are in right now is because of the decline that BTC has registered recently.

Before this plummet, the asset had been in endless consolidation, so as these STHs had participated in buying and trading at those levels, they had gained their cost basis there.

With the plunge, the price has naturally dropped below the cost basis of many of these holders, thus leading to the supply in profit also observing a sharp plummet.

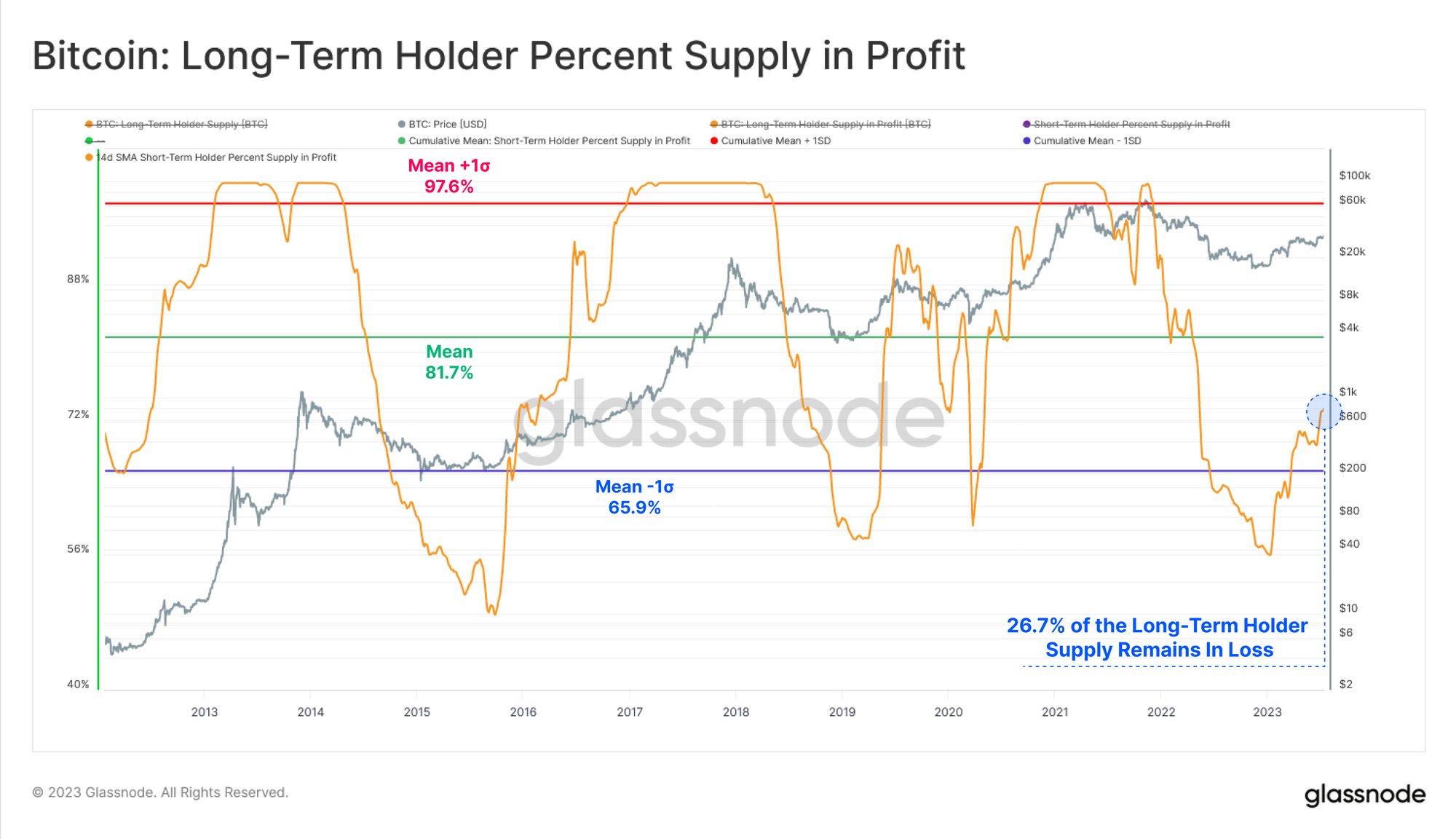

While the STHs are deep underwater, the long-term holders (LTHs) have only seen their supply profitability increase recently.

How can it be possible for the LTH supply in profit to go up, when the price has been going down? Well, there is a simple explanation: the LTHs are investors who bought at least 155 days ago, so this means that there is a 155-day delay attached between an investor buying their coins and them being counted under this supply.

Supply from five months ago matured into the cohort recently, and since this supply is being held at a profit right now (due to the lower prices back then), the LTH supply in profit has gone up.

BTC Price

Bitcoin has registered a 4% surge during the past 24 hours as its price has now crossed the $26,100 mark.