Dogecoin Vs Shiba Inu: How Do The Memecoins Compare In On-Chain Metrics?

Here’s how the various memecoins in the market, like Dogecoin and Shiba, compare against each other in terms of the on-chain indicators.

Dogecoin, Shiba Inu, And Other Memecoins Stacked Against Each Other

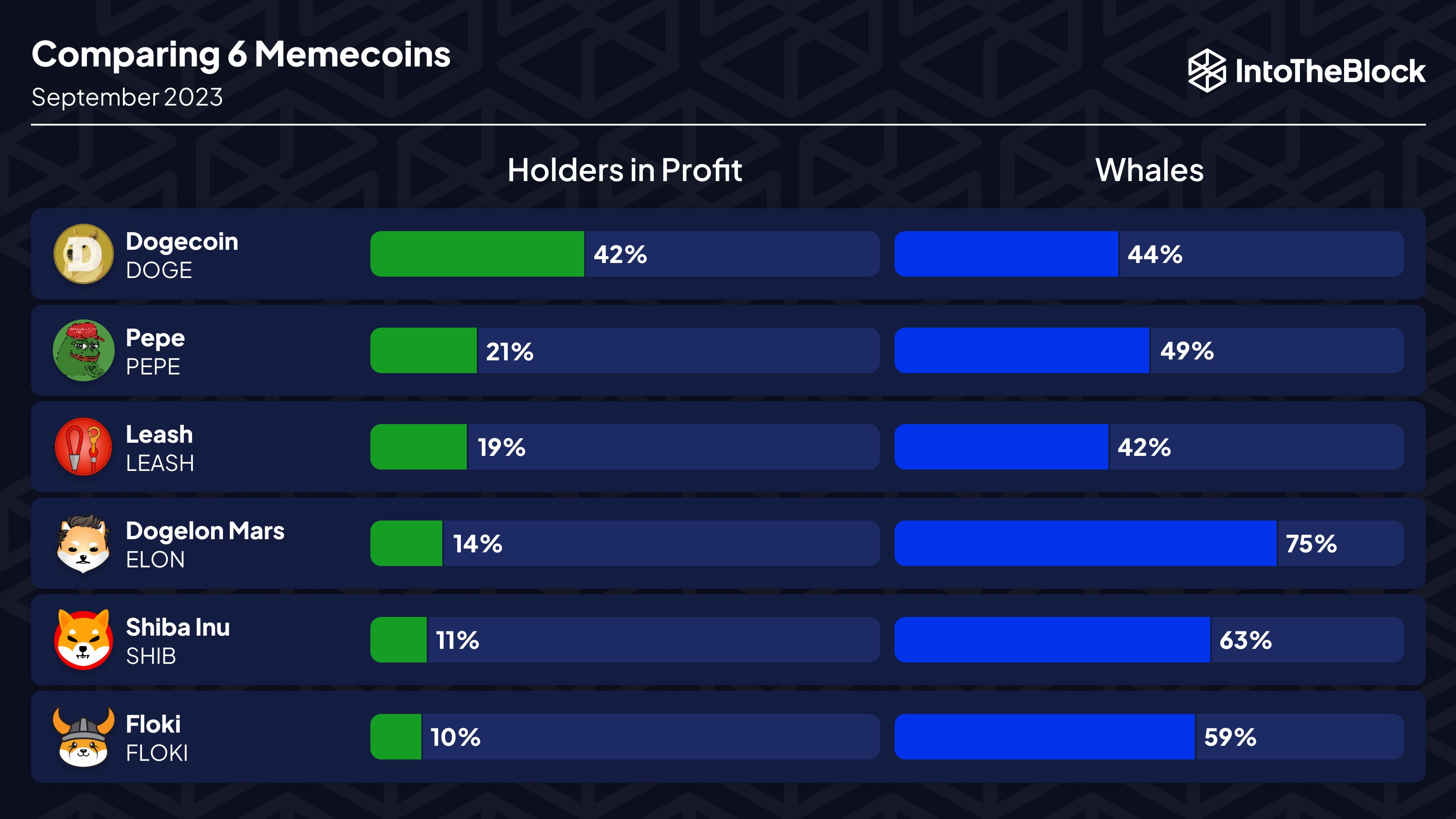

In a new post on X, the market intelligence platform IntoTheBlock shared an infographic that looks into the underlying metrics of the different memecoins in the sector.

The firm has compared these assets based on two indicators: the holders in profit and the whale concentration. The former tells us about the total percentage of the investors of assets currently sitting in the green.

This metric works by going through the transaction history of each address to see the average price at which they acquired their coins. If this average buying price for any holder was less than the current spot value of the cryptocurrency, then that investor is carrying a net profit.

The other metric, the whale concentration, measures the total percentage of the supply of the coin that the whales carry in their addresses. According to IntoTheBlock, “whale” entities refer to all addresses that hold at least 1% of the asset’s supply.

Now, here is how these indicators currently look like for six popular memecoins in the sector: Dogecoin (DOGE), Pepe (PEPE), Leash (LEASH), Dogelon Mars (ELON), Shiba Inu (SHIB), and Floki (FLOKI).

The table shows that Dogecoin is the number one memecoin in terms of the holders in profit metric. When the analytics firm shared this infographic, 42% of all investors of DOGE were enjoying profits.

While this value is greater than for the other memecoins, it’s still relatively low, as it means that most of the Dogecoin holders are currently underwater.

The next best coin, Pepe, only has 21% of the investors in profit, while SHIB, the second largest memecoin in the market cap, is fifth with nearly 90% of investors in the red.

Generally, the fewer holders are in profit, the more likely a rebound will occur, as investors in profit are the more probable bunch to sell at any point, so a lack of them can suggest a reduced possibility of a selloff taking place.

Whale concentration-wise, Leash seems to be the healthiest coin right now, as these humongous investors control about 42% of the asset’s supply. Dogecoin isn’t too far behind, as the whales of the original memecoin hold about 44% of the supply.

Shiba Inu, Dogelon Mars, and Floki all see the whales control most of the respective asset’s supply, implying that these assets are highly concentrated on the few large holders.

The supply being centralized on the whales is never positive, as it means that these influential entities can easily move the market on their own, thus increasing the possibility of a rug pull taking place.

DOGE Price

Dogecoin has been steadily on its way down recently as the asset is trading around the $0.06 level right now, having declined by almost 5% in the past week.