Sharp Decline In Miner Balances Suggests Incoming Selling Pressure For Bitcoin

Bitcoin miners have always controlled a reasonable portion of the BTC supply and as such, when they start selling, it can be very bearish for the digital asset. This time around, there has been a significant decline in the holdings of these BTC miners, which suggests that they made be selling again.

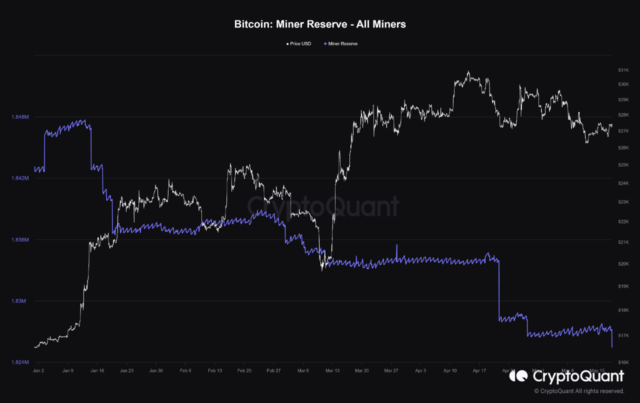

Bitcoin Miner Reserves See Sharp Decline

Since the year began, Bitcoin miners have been leaning more toward selling to make ends meet for their operations. This is evident in the declines that have been recorded in their balances after what seemed like a long year of accumulation back in 2022.

As a result, the current Bitcoin miner balances are sitting at about 50% lower than they did at the start of the year, and it doesn’t seem like they’re done selling. This is because data from CryptoQuant shows that miners moved thousands of BTC over the past day with the destination said to be centralized exchange Binance.

The on-chain data aggregator highlighted two transactions carrying 1,750 BTC each headed toward Binance. At the time, both of these transactions were worth $47 million, leading to the sharp decline that was recorded in the holdings of BTC miners.

Usually, moving BTC from one wallet to another is not alarming. But when the destination of these coins happens to be centralized exchanges, it becomes something to worry about for market participants.

BTC Miners Could Tank The Market

With $47 million expected to move into Binance from the Bitcoin miners, there could be more selling pressure being mounted on the cryptocurrency. BTC is already experiencing significant selling pressure, which has seen its price fall below $27,000 once again, and the miners selling their BTC could make this even worse.

According to the chart posted on CryptoQuant, it’s obvious that there has always been a significant decline in the BTC price whenever miners moved such large amounts. This time around, it seems the recent recovery above $27,000 is what spurred the move and it could point to miners trying to take advantage of the higher prices if they expect Bitcoin to keep declining.

The last time such a move occurred was in early April and BTC lost around $4,000 from its value. If this repeated itself, then the digital asset could fall to $24,000 before demand picks up enough to trigger a recovery.

As of the time of writing, the BTC price is already falling. It is trading at $26,849 with a 1.88% decline in 24 hours.