Tether (USDT) Emerges as Prefered Stablecoin amid US Banking Crisis with Over $86B in Total Supply

Coinspeaker

Tether (USDT) Emerges as Prefered Stablecoin amid US Banking Crisis with Over $86B in Total Supply

The rise of the Tether (USDT) stablecoin has been undisputed for several years. The Tether (USDT) stablecoin runs on more than 10 blockchains including Ethereum, Binance Smart Chain, Polygon, and Tron, among others. On the Ethereum network, Tether (USDT) has more than $36 billion in supply with about 4.3 million holders. The Tron network holds a vast amount of Tether (USDT) with about $46 billion. On the Solana blockchain, Tether (USDT) has a total supply of about $1.8 billion.

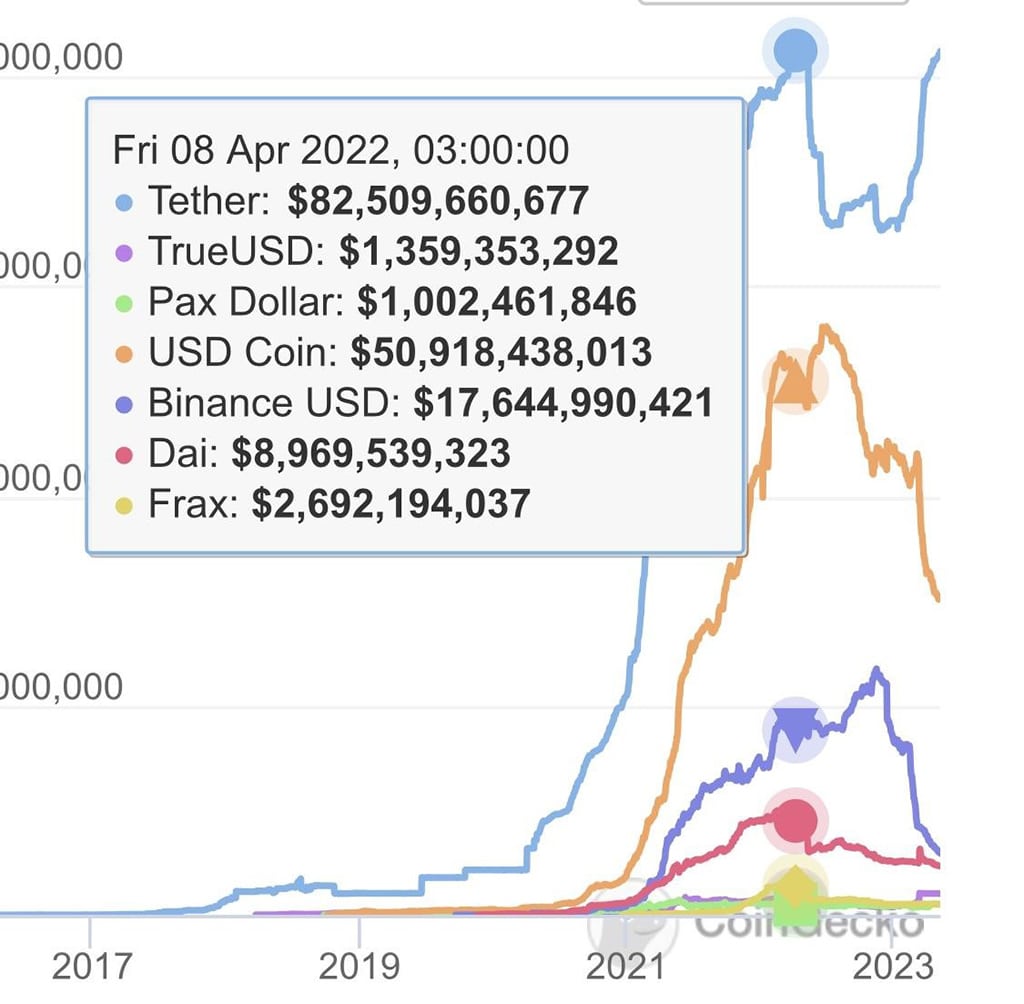

In total, the Tether (USDT) has a total supply of more than $82 billion, thus holding the top US dollar-backed stablecoins. Notably, Tether (USDT) has the highest daily traded volume in the digital asset industry with about $25.57 billion, compared to Bitcoin at $16.5 billion.

Banking Crisis Lifts Tether (USDT)

Amid the United States banking crisis, which has seen more than three regional banks succumb to fintech and big valued banks, investors are more aware of self-custody through stablecoins. According to the latest aggregate data from CoinGecko, the Tether USDT market valuation has reclaimed ATH achieved right before last year’s crypto capitulation.

Notably, Tether USDT bottomed out at a market capitalization of about $65 billion during the FTX and Alameda Research implosion late last year. With the de-pegging of Circle’s USDC during the collapse of Silvergate Capital, Tether USDT’s valuation climbed exponentially to date.

The narrative that Bitcoin is a better hedge against inflation than any other market equities has increased the adoption of Tether stablecoins.

“The banking crisis is fuelling ‘hyper-bitcoinisation’ – the inevitable endgame that the dollar will be worthless,” said Anders Kvamme Jensen, Oslo-based founder of the AKJ global brokerage and digital asset specialist.

King of the Stablecoin Market

The stablecoins market cap is about $130,788,346,187, with Tether controlling more than half. According to aggregate data from Binance-backed CoinMarketCap, only Tether (USDT) has seen its market valuation increase YTD in the top three stablecoins. The second largest stablecoin, USDC by Circle has been on a decline since the Silvergate Capital saga.

Similarly, Binance-backed BUSD has significantly shrunk since the issuer ceased issuing new coins following the SEC charges.

Photo: CoinGecko

Bigger Picture

The stablecoins market is expected to significantly grow amid the mainstream adoption of Bitcoin and other digital assets globally. Moreover, there are more crypto-friendly markets – including the EU, Hong Kong, UK, El Salvador, and UAE, among others – than there were a few years ago.

As a result, Tether (USDT) is expected to grow exponentially in the coming years. Furthermore, the company has launched more stablecoins denominated in other global currencies including the Euro.

Tether (USDT) Emerges as Prefered Stablecoin amid US Banking Crisis with Over $86B in Total Supply