Top 5 Decentralized Exchanges in 2022

Decentralized exchanges (DEX) have emerged as an alternative to centralized exchanges allowing people to swap crypto assets on a peer-to-peer basis with no third party involved. The number of new DEXs is increasing by days if not by hours. So, how to choose the most prospective and innovative decentralized exchange? Let’s lift up a curtain on this golden list.

Uniswap V3

Uniswap V3 is the improved version of the Uniswap protocol – one of the most popular Ethereum-based DeFi protocols in the crypto market. It works according to the AMM model with liquidity providers and liquidity pools. The main bullet of V3 is concentrated liquidity resulting in higher capital efficiency for traders and deeper liquidity for liquidity providers. With the large trading volume, Uniswap has proved as one of the main DeFi protocols in the crypto industry.

Algebra

Algebra is the concentrated liquidity DEX with Built-in Farming and Dynamic fees which reduce impermanent loss and maximize profit both for liquidity providers and traders; finding the right balance between them. With such game-changing features, Algebra has all the cards to compete with Uniswap V3. As of now, only on Uniswap and Algebra you can use liquidity positions. Algebra allows you to swap crypto, provide liquidity, stake ALGB native tokens, and participate in farming to earn extra incentives — starting from less than a dollar.

SushiSwap

Sushi is a decentralized protocol including a decentralized exchange and lending market. Incentivizing users to operate the platform, SushiSwap enables yield instruments and staking derivatives. With a collection of liquidity pools, SushiSwap lets users lock up their assets, and traders buy and sell crypto from these pools. In 2020, SushiSwap merged with Yearn.finance to share development resources, but so far maintains separate tokens and governance systems.

Curve

Curve is a decentralized exchange protocol designed to lower fees and slippage for swapping stablecoins. Based on the Ethereum blockchain, Curve remains the best place to exchange not only stablecoins but tokenized versions of Bitcoin (renBTC, sBTC, WBTC) as well. The fees are determined by the Curve Decentralized Autonomous Organization (DAO) and go to liquidity providers and other members of the DAO half by half.

QuickSwap

QuickSwap runs on the same liquidity pool model as Uniswap and has become popular due to the speed and low fees offered by the Polygon blockchain. QuickSwap is compatible with Ethereum blockchain as well, so you can exchange ERC-20 tokens on QuickSwap as well. Among the tokens available on the platform, you can find many wrapped tokens such as WETH (Wrapped ETH), WBTC (Wrapped BTC), stablecoins, and many others.

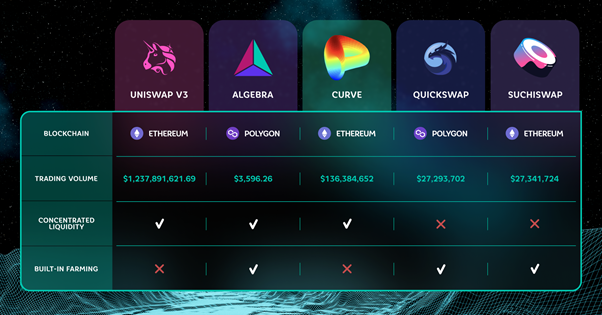

Now you’re armed with the best places to capitalize on your crypto assets with no intermediary. Choosing the decentralized exchange that will meet your expectations is essential. In the table below, you can compare the DEXs and make the right choice!