Almost $200 Billion Worth Of Bitcoin Is Currently At Risk – Report Warns

A recently published 2021 crypto report by Opimas LLC, a finance-based management consultancy firm, has revealed that approximately 3,480,000 out of the world’s mined 18.5 million Bitcoin, stands vulnerable to attacks as a result of improper safekeeping.

The 36-page report by the Boston-based management company extensively covered the various institutional safekeeping gaps – capable of predisposing owners of cryptocurrencies to coin theft – that are still present and in need of solutions, in the world of crypto.

What Are The Key Takeaways?

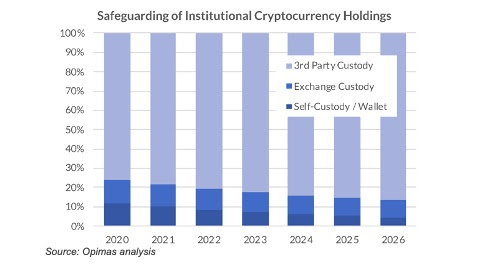

One of the key takeaways Opimas highlights in its report is the need for the establishment of more middlemen in cryptocurrencies. These middlemen can exist in the form of institution-based custody solution providers, that is, the provision of solutions that help store, exchange, and hold cryptocurrency safely for big investors and corporations.

This recommendation is gleaned from the reality that more and more corporate bodies and institutions are now beginning to invest heavily in crypto, following Michael Saylor’s MicroStrategy and electric car manufacturer’s footsteps Tesla, as part of their asset diversification plan. But as it currently seems, there are very few standard holding or safekeeping solutions designed to handle such a volume of transactions and many of them still deploy security technologies suitable only for small-scale individual buyers.

Another inevitable middleman coming to the crypto space is traditional financial institutions. The report foretells that in the future, many more banks across the globe will begin to accept the deposit, transfer, and withdrawal of digital currencies just like they do for fiat money.

Is The Crypto World Going Astray?

While this is desirable, Opimas journeys down history to explain that it is an inevitable tangent away from the original dream of the pioneer creator(s) of Bitcoin, which was to create a space for digital currencies that stands as a solid antithesis to fiat money and the whole activities of regulation centralization. This meant the elimination of middlemen such as banks, trading, holding, and insurance companies making digital coins strictly a mine-to-have and mine-to-sell-only type of currency.

But as maturity and growth have deemed fit, many years down the line and with a booming trillion-dollar market, it has become clear that the crypto industry needs to go astray as it cannot do without the role of intermediaries. This means the next phase of growth that the crypto industry targets can only come when many high-value intermediary service providers start offering safe and secure solutions that target mostly big corporate investors for a stipulated transaction fee.

The Types of Crypto Middlemen

Opimas groups these intermediaries into three categories: those that create the platform for keeping coins such as Coinbase, Crypto Finance, and Paxos; those that provide the technology behind it, such as Base Zero, Ledger, and Taurus and those that combine both functions on their platforms such as BitGo, Tangany and Crypto Storage.

Cuddling Up With The Government

Another remarkable development is the successful synergy of the industry with government regulatory agencies. Opimas reports that countries like Germany, France, Switzerland, Singapore, the UK, and Canada are working towards or already have concrete regulations in place to shape the trajectory of the market.

Since the ever-fresh Mt.Gox incident, seven years ago, over 800,000 Bitcoins were siphoned from various hot wallets, over $50 billion worth of cryptocurrencies have been successfully targeted by hackers, stressing the urgent need for security. Opimas elucidates that a large chunk of these thefts targeted hot wallets – the type of wallet used by a greater percentage of individuals holding cryptocurrencies. This exposes the need for risk management and insurance providers to come on board the crypto space as another important middleman.

As can be seen, no industry is an island and for the world of crypto to mature towards legitimacy and widespread legalized acceptability, it must work with the government, work with the banks, work with insurance companies and improve its security function to make all investors – big or small, feel safe with it. Opimas believes that there are no more excuses at this point.