Yearn.Finance Adding $100 Million Daily With $2.5B TVL

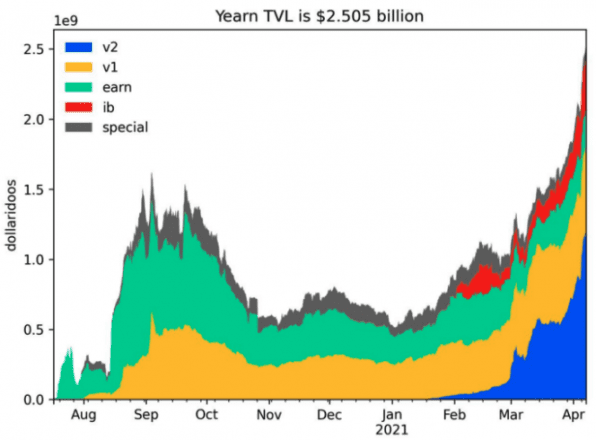

Yearn.Finance has seen astronomical growth in the last few weeks as the protocol’s total value locked reached $2.5 billion.

Yearn’s Active Asset Management Is Underrated

After bursting onto the DeFi scene in August 2020, the project seems to have truly hit its stride in the last few months. In their most recent weekly update State of the Vaults, they announced they passed the milestone of $2.5 billion locked in their vaults.

Behind this rise in price is the increasing value captured by Yearn’s v2 vaults. Announced in January, they originally didn’t capture much value as the strategies didn’t perform as well as other vaults and protocols in DeFi.

The team also drew controversy earlier in the year by minting $200 million worth of YFI to ensure the development of the DeFi protocol could continue to be supported independently in the coming years.

Feeling FOMO about the latest farm of the week?

Worry not, Yearn Strategists have your weekend covered, go enjoy life while Yearn finds the best yield for you.

Funds in WETH, WBTC, USDC, DAI yVaults will be deployed shortly. Current estimated APR varies from 304% to 460%.

— banteg (@bantg) April 11, 2021

The team behind Yearn is also affirming the crazy APYs will keep on coming, with estimated APRs in the triple digits. This has seen an increasing amount of DeFi users entrust Yearn with their capital.

Yearn has effortlessly onboarded over $100m/day several times over the past few weeks. Imagine a legacy company doing this, impossible.

— banteg (@bantg) April 12, 2021

As moving funds on the Ethereum blockchain becomes increasingly expensive, active portfolio management group strategies become more appealing. Jumping from one farm to the next is a luxury few can afford.

Disclaimer: The author held ETH, BTC and a number of other cryptocurrencies at the time of writing.