Quarterly Cryptocurrency Market Analysis [Q1 2018]

Information as of April 2, 2018

This report was created by:

- Professor Dmitrii Kornilov, Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox;

- Dima Zaitsev, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox;

- Nick Evdokimov, Co-Founder of ICOBox;

- Mike Raitsyn, Co-Founder of ICOBox;

- Anar Babaev, Co-Founder of ICOBox;

- Daria Generalova, Co-Founder of ICOBox

This report presents data on cryptocurrency market changes during 2017-2018. Special emphasis has been placed on an analysis of the changes that took place in the first quarter of 2018, including over the last week (March 26-April 1, 2018).

1. General cryptocurrency and digital assets market analysis (by week, month, quarter). Market trends.

1.1 General cryptocurrency and digital assets market analysis (by week, month).

Table 1.1. Trends in capitalization of the cryptocurrency market and main cryptocurrencies from December 1, 2017, to April 1, 2018*

| Parameter | 1-Dec-17 | 1-Jan-18 | MoM, % | 1-Feb-18 | MoM, % | 1-Mar-18 | MoM, % | 1-Apr-18 | MoM, % | |

| 1 | Total market capitalization, USD billion | 305.1 | 612.9 | 100.9% | 517.2 | -15.6% | 440.0 | -14.9% | 263.9 | -40.0% |

| 2 | Altcoin market capitalization, USD billion | 134.7 | 376.2 | 179.3% | 344.8 | -8.3% | 264.6 | -23.3% | 145.2 | -45.1% |

| Altcoin dominance, % | 44.1% | 61.4% | – | 66.7% | – | 60.1% | – | 55.0% | – | |

| 3 | Bitcoin price, $ | 10 198.6 | 14 112.2 | 38.4% | 10 237.3 | -27.5% | 10 385.0 | 1.4% | 7 003.1 | -32.6% |

| Bitcoin market capitalization, USD billion | 170.4 | 236.7 | 38.9% | 172.4 | -27.2% | 175.4 | 1.8% | 118.7 | -32.3% | |

| Bitcoin dominance, % | 55.9% | 38.6% | – | 33.3% | – | 39.9% | – | 45.0% | – | |

| 4 | Ethereum price, $ | 445.2 | 755.8 | 69.8% | 1 119.4 | 48.1% | 856.0 | -23.5% | 397.3 | -53.6% |

| Ethereum market capitalization, USD billion | 42.8 | 73.1 | 70.9% | 109.0 | 49.1% | 83.8 | -23.1% | 39.1 | -53.3% | |

| Ethereum dominance, % | 14.0% | 11.9% | – | 21.1% | – | 19.0% | – | 14.8% | – | |

| 5 | Bitcoin Cash price, $ | 1 381.8 | 2 534.8 | 83.4% | 1 491.1 | -41.2% | 1 204.8 | -19.2% | 688.0 | -42.9% |

| Bitcoin Cash market capitalization, USD billion | 23.3 | 42.8 | 84.1% | 25.3 | -41.0% | 20.5 | -19.0% | 11.7 | -42.7% | |

| Bitcoin Cash dominance, % | 7.6% | 7.0% | – | 4.9% | – | 4.7% | – | 4.4% | – | |

| 6 | Litecoin price, $ | 88.0 | 231.7 | 163.3% | 163.7 | -29.3% | 203.1 | 24.1% | 116.9 | -42.4% |

| Litecoin market capitalization, USD billion | 4.8 | 12.6 | 165.6% | 9.0 | -28.8% | 11.3 | 25.0% | 6.5 | -42.0% | |

| Litecoin dominance, % | 1.6% | 2.1% | – | 1.7% | – | 2.6% | – | 2.5% | – | |

| 7 | Volume (24h) 4 crypto, USD billion | 9.2 | 15.7 | 71.1% | 17.3 | 10.2% | 10.1 | -41.4% | 6.4 | -36.9% |

| Market cap 4 crypto, USD billion | 246.1 | 441.6 | 79.4% | 351.6 | -20.4% | 315.1 | -10.4% | 189.7 | -39.8% | |

| ZAK-4 Crypto index | 3.7% | 3.6% | – | 4.9% | – | 3.2% | – | 3.4% | – | |

| 4 crypto dominance, % | 80.7% | 72.0% | – | 68.0% | – | 71.6% | – | 71.9% | – | |

| 8 | Volume (24h) 8 crypto, USD billion | 10.3 | 17.2 | 67.5% | 19.0 | 10.2% | 11.3 | -40.3% | 7.2 | -36.3% |

| Market cap 8 crypto, USD billion | 263.5 | 488.6 | 85.4% | 393.4 | -19.5% | 349.3 | -11.2% | 208.7 | -40.2% | |

| ZAK-8 Crypto index | 3.9% | 3.5% | – | 4.8% | – | 3.2% | – | 3.5% | – | |

| 8 crypto dominance, % | 86.4% | 79.7% | – | 76.1% | – | 79.4% | – | 79.1% | – |

* Data as of April 1, 2018 (all figures calculated at 03:00 UTC)

** Since December 1, 2017, the ZAK-4 index has been calculated using the cryptocurrencies Bitcoin, Ethereum, Ripple, and Bitcoin Cash.

*** When calculating the ZAK-8 index, the cryptocurrencies with the largest capitalization are used. At present (April 1, 2018), the cryptocurrencies Bitcoin, Ethereum, Ripple, Bitcoin Cash, Cardano, Litecoin, Stellar, and EOS are used to calculate the ZAK-8 index.

Data source: coinmarketcap.com,smithandcrown.com

During the first quarter of 2018 cryptocurrency market capitalization was more than halved, and as of 03:00 UTC on April 1, 2018, equaled $263.9 billion (see Table 1.1, fig. 1). In January capitalization dropped by 15.6%, in February by 14.9%, and in March by 40%.

The dominance of the four and eight largest cryptocurrencies as of 03:00 UTC on April 1, 2018, equaled 71.9% and 79.1%, respectively. Bitcoin dominance increased over the quarter from 38.6% to 45% (see Table 1.1), i.e. one can conclude that in general altcoins depreciated more drastically in January-March than the leader of the cryptocurrency market.

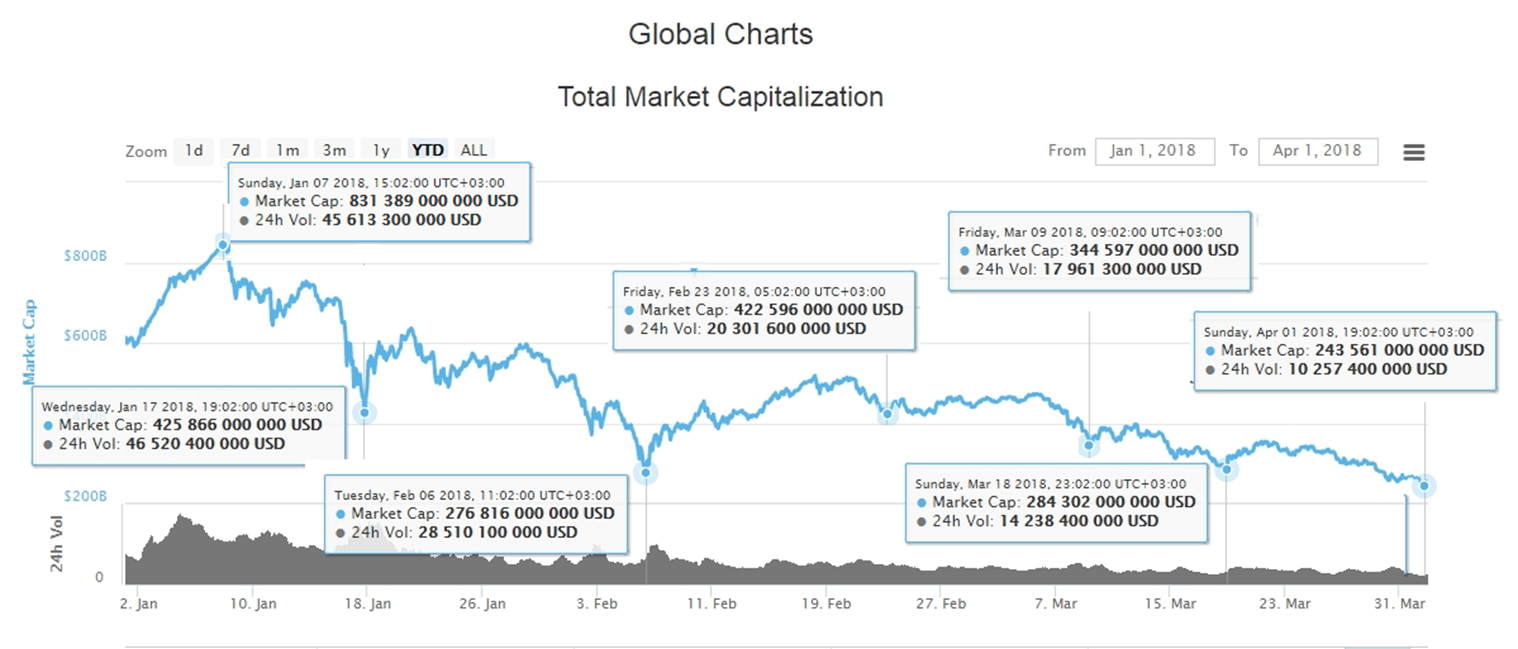

The most significant changes in the amount of cryptocurrency market capitalization during the first quarter of 2018 are shown in fig. 1. These changes were related to numerous events (see Table 1.4).

Figure 1. Cryptocurrency market capitalization since January 1, 2018

Data source: coinmarketcap.com

We will look at the reasons for the market decline of select cryptocurrencies on the dates:

Decline in capitalization from January 8-17, 2018

- Сoinmarketcap.com excluded the trading volumes of several South Korean exchanges from its analytics, in particular Bithumb (the second largest cryptoexchange in the world), Coinone and Korbit, and also stopped taking the trading results of Upbit and Coinnest into account. As a result, the indicators of nearly all cryptocurrency and digital assets underwent changes, which sparked a wave of market exits through sales and led to a considerable reduction in total cryptocurrency market capitalization (January 8, 2018).

- Information appeared in the media that the head of the Ministry of Justice of South Korea was planning to introduce a ban on trading in cryptocurrencies through exchanges (January 11, 2018). This information was subsequently refuted.

- It became known through Bloomberg reports that Beijing was planning to block domestic access to Chinese and foreign cryptoexchange platforms that provide centralized trading services (January 15, 2018). News from China and South Korea always has a serious impact on cryptocurrency markets, as these countries account for a considerable share of total trading in digital currencies.

- The start of Chinese New Year celebrations (in 2018 during the period from February 15-21) led to a fall in activity on exchanges.

Decline in capitalization on February 6, 2018

- Synchronized movement of the Dow Jones Industrial Average (DJIA) and the bitcoin price. On February 5 the Dow Jones index fell by 4.6% over the course of one day, i.e. by more than 1,000 points, which is the largest daily drop in the US stock index in the past 10 years, after the publication of the US Department of Labor’s employment and wages statistics. Following in the footsteps of the DJIA, similar trends were seen on the S&P Index, Nasdaq Composite, Nikkei 225 and other indices, which fell from February 6-10, 2018. The price of oil also dropped.

- China blocked access to all foreign cryptoexchanges (February 6, 2018)

Decline in capitalization from March 8-9, 2018

- The SEC demanded that cryptoexchanges trading in tokens that meet the definition of a security under the Securities Act register with the Commission as national stock exchanges (March 7, 2018).

- As a result of a hacker attack on the Binance exchange, funds were withdrawn from a number of accounts through the purchase of Viacoins (VIA), the price of which immediately increased a hundredfold. Users that relied on trade bots (API keys) were hit the hardest (March 7-8, 2018).

- The trustee of the bankrupt Mt. Gox exchange published an announcement on the sale of Bitcoin and Bitcoin Cash worth $400 million and the possible sale of other digital assets worth $1.8 billion (March 8, 2018).

Decline in capitalization from March 15-18, 2018

- Information appeared on March 14 stating that Google, following the lead of Facebook and Instagram, had announced its intention to ban all advertising related to the crypto industry and ICOs on its platform to protect its consumers;

- On the eve of the G20 summit, scheduled for March 19-20, at which the issue of global control over the crypto industry was to be considered, capitalization initially fell, but by the evening of March 18 a growth in prices and activity began to be seen for nearly all cryptocurrencies and digital assets;

- Twitter will ban advertising related to the crypto industry in two weeks (March 19, 2018). After Facebook and Google, Twitter also decided to ban all advertising related to the crypto industry. The consequences of this event, as well as pressure from other media, messengers and social networks (Snapchat, Audience Network, Instagram), resulted in a steady decline in cryptocurrency market capitalization, including over the past week. However, these events also had a boomerang effect on the share prices of these companies (for example, Twitter’s share price fell from $36 to $28).

Price change during Q1 2018 among the leaders of the cryptocurrency market

Table 1.2 shows the price change for 12 cryptocurrencies during Q1 2018. This list of coins and tokens was compiled based on the Top 10 cryptocurrencies by capitalization at the start of the year (shown in blue) and as of April 1, 2018. The prices of the Top 12 cryptocurrencies by capitalization fluctuated by more than a factor of two over the past quarter (High / Low). The NEM and Cardano cryptocurrencies endured especially large fluctuations from $2.09 to $0.20 and from $1.33 to $0.13, respectively, i.e. more than a tenfold difference between their high and low prices for the quarter. Ripple and Stellar were also subject to considerable fluctuations (see Table 1.2).

Table 1.2. Price changes in Top 12 cryptocurrencies by capitalization during the period from January 1-April 1, 2018

| № | Name | Price Open, $ | QoQ, | Price change during the quarter | High / Low | |||||

| 01.01.2018 | 01.02.2018 | 01.03.2018 | 01.04.2018 | % | High, $ | Low, $ | D, $ | |||

| 1 | Bitcoin | 14 112.20 | 10 237.30 | 10 385.00 | 7 003.06 | -50.4% | 17712.40 | 6048.26 | 11 664.14 | 2.93 |

| 2 | Ripple | 2.30 | 1.16 | 0.90 | 0.51 | -77.7% | 3.84 | 0.47 | 3.37 | 8.24 |

| 3 | Ethereum | 755.76 | 1 119.37 | 856.01 | 397.25 | -47.4% | 1432.88 | 363.81 | 1 069.07 | 3.94 |

| 4 | Bitcoin Cash | 2 534.82 | 1 491.12 | 1 204.84 | 688.01 | -72.9% | 3071.16 | 629.93 | 2 441.23 | 4.88 |

| 5 | Cardano | 0.72 | 0.52 | 0.31 | 0.16 | -78.2% | 1.33 | 0.13 | 1.20 | 10.47 |

| 6 | Litecoin | 231.67 | 163.68 | 203.12 | 116.91 | -49.5% | 323.12 | 105.35 | 217.77 | 3.07 |

| 7 | IOTA | 3.56 | 2.31 | 1.85 | 1.08 | -69.7% | 4.58 | 0.96 | 3.62 | 4.79 |

| 8 | NEM | 1.04 | 0.79 | 0.40 | 0.22 | -78.7% | 2.09 | 0.20 | 1.89 | 10.55 |

| 9 | Dash | 1 054.07 | 698.79 | 584.14 | 306.21 | -70.9% | 1394.28 | 285.68 | 1 108.60 | 4.88 |

| 10 | Stellar | 0.36 | 0.54 | 0.33 | 0.21 | -42.4% | 0.94 | 0.16 | 0.78 | 5.90 |

| 11 | NEO | 76.19 | 145.96 | 133.65 | 50.34 | -33.9% | 196.85 | 45.30 | 151.55 | 4.35 |

| 12 | EOC | 8.77 | 12.24 | 8.39 | 6.00 | -31.6% | 18.71 | 3.95 | 14.76 | 4.74 |

| Portfolio 12 crypto | -58.6% | |||||||||

Data source: coinmarketcap.com

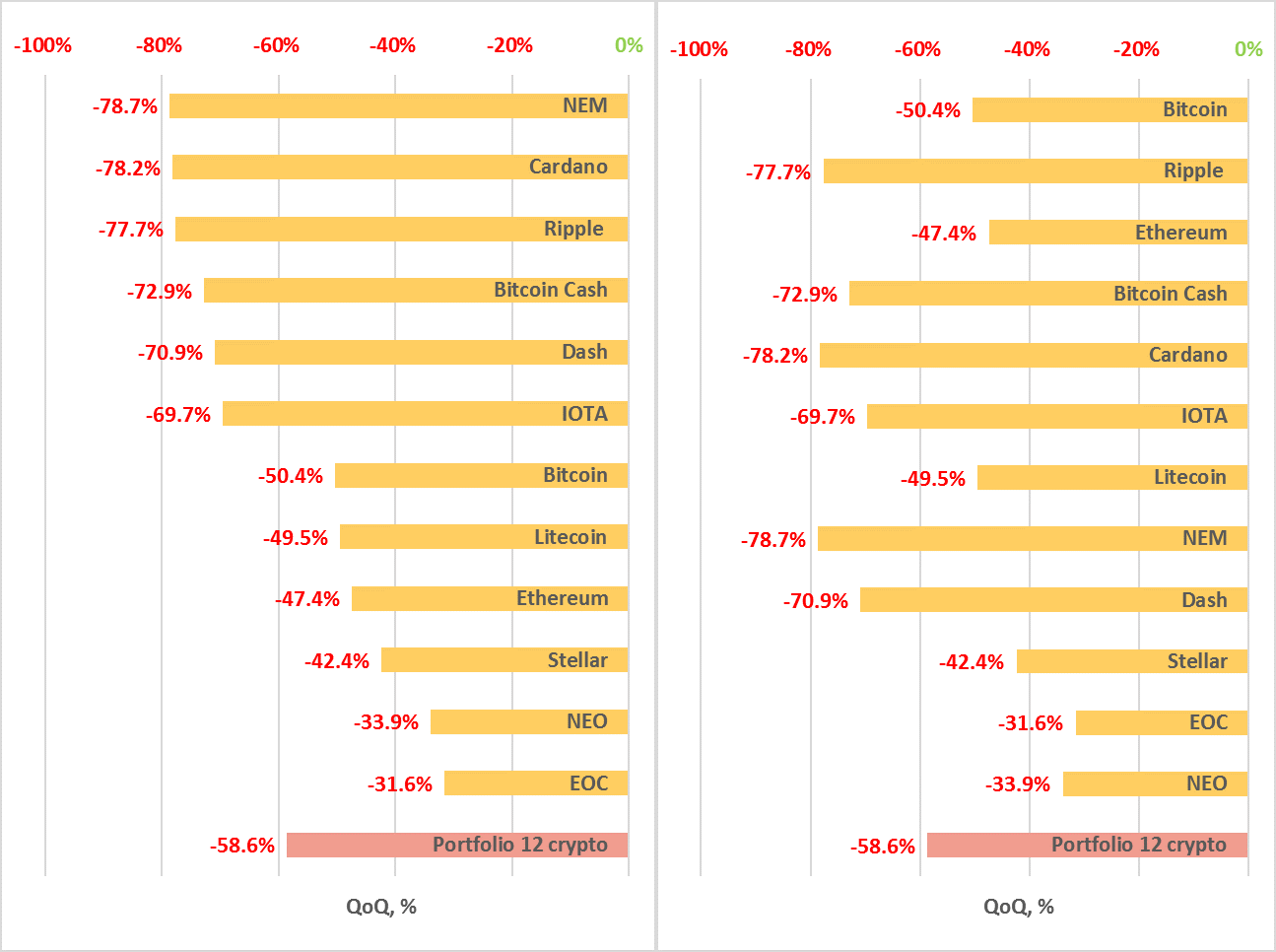

Thus, from January 1-April 1, 2018, a fall in price compared to the start of the year of -31.6% (EOC) to -78.7% (NEM) was seen among the leading cryptocurrencies by capitalization (fig. 2). The average yield of a portfolio consisting of equal shares of the cryptocurrencies in the Top 12 (Portfolio 12 crypto) for the quarter was negative and equaled -58.6%. Overall, cryptocurrency market capitalization fell in the first quarter by -54.7% compared to the start of the year.

Figure 2. Price change in Top 12 cryptocurrencies by capitalization during Q1 2018, %

(left – cryptocurrencies ranked by the amount of the fall in their prices, right – by amount of capitalization at the start of 2018)

After the sustained growth in the cryptocurrency market throughout 2017, most cryptocurrencies and digital assets underwent a serious downward adjustment in January and early February. The price of the most popular coins and tokens depreciated significantly, to the level seen in early December.

Many experts predicted this downward adjustment, as it happens after every wave of market growth. The bitcoin price trend is usually the signal for market participants, with skyrocketing growth often followed by an average 30-50% fall, leading to a downward adjustment in the price of all altcoins as well. In February total cryptocurrency market capitalization fell by another 15%, from $517 billion to $440 billion at the end of the day on February 28 (https://coinmarketcap.com/charts/). The market also showed a negative trend in March, and by the end of the first quarter of 2018 market capitalization had fallen to $260 billion, to the level at the end of November.

The bitcoin price dropped by 50% during the first quarter, which is slightly less than the drop in total market capitalization. This is due to the lower volatility of bitcoin compared to altcoins, as well as the significant reduction in transaction fees inside the bitcoin network as a result of the wider use by major players of new technologies that facilitate scalability. For example, on February 20 the cryptoexchanges Coinbase and Bitfinex announced their integration with SegWit.

Ripple was among the five coins from the Top 12 that saw a fall in capitalization of more than 70%, which might have been the result of its clearly inflated price at the end of December and in early January caused by heightened speculative demand. This quarter was also very unpleasant for Dash, the 70.9% fall in which was caused to a large degree by its delisting from the Japanese cryptoexchange Coincheck. According to media reports, the reason for the delisting was Coincheck’s extreme concern with the anonymity provided by these virtual currencies.

NEM, which dropped by more than 80%, was the fastest falling coin among the Top 12. The worst news for NEM during the quarter was the theft of coins worth around $400 million from the Japanese exchange Coincheck. The price of Cardano also fell by nearly 80%. The price recovered very poorly after the market crash on February 6, and was unable to restart a favorable trend. Its trading volumes remained low compared to the start of the year, which apparently reflected a fall in the interest of market players in this coin.

The first quarter of 2018 was only slightly more successful for Litecoin than for the other coins in the Top 12. Its price fell by 50%, which is slightly better than the average market indicator. This is largely explained by the fact that Litecoin grew by more than 35% on February 14, reaching approximately $215 on February 15. This upswing during a market decline was caused by the announcement of the new payment infrastructure Litepay for Litecoin published on February 13.

The remaining coins from the Top 12 – Ethereum, IOTA, Stellar and EOS – also followed the negative market trend caused by the prolonged downward adjustment and the largely negative tone of the news items related to the strengthening of regulation of the crypto industry in leading countries.

However, NEO showed a somewhat better result against this backdrop, falling by only 31.6% over the quarter thanks to the news published on February 26 that the Weiss rating agency had assigned this cryptocurrency an A rating, which caused an immediate 15% growth in its price. You will recall that this was the first time in history that a cryptocurrency had been assigned such a high rating. The NEO price was also favorably impacted by the airdrop of Ontology tokens among NEO token holders.

The free distribution of Ontology tokens (ONT) was planned after March 1 at a rate of 1 NEO : 0.2 ONT. It should be noted, however, that the ability to dispose of Ontology tokens will be partially frozen due to a temporary block placed on them.

Growth in the trading activity index on cryptoexchanges

To analyze trading activity on cryptocurrency exchanges, the ZAK-n Crypto index is calculated (see the Glossary). The 24-hour trading volumes (Volume 24h) for the four and eight dominant cryptocurrencies decreased by approximately half during the first quarter (Table 1.1), which attests to a fall in activity on cryptoexchanges.

The values of the ZAK-4 Crypto indexes are shown in Tables 1.1, 1.3. In January-March the 24-hour trading volumes (Volume 24h) of the four dominant cryptocurrencies (Bitcoin, Ethereum, Bitcoin Cash, Ripple) equaled from $6 to $25 billion (Table 1.3). The daily ZAK-4 Crypto index equals 3-4% of capitalization on average, but during certain periods it has exceeded 10%.

For example, on February 6, 2018, during the significant downward adjustment of the cryptocurrency market, the index increased to 10.3%, and it increased once again on March 18, on the eve of the G20 summit. This speaks to the extremely high liquidity and market dynamism of the dominant cryptocurrencies. On April 1, 2018, the 24-hour trading volumes of the four dominant cryptocurrencies equaled $6.4 billion, i.e. 3.4% of their market capitalization (Table 1.3).

Table 1.3. Daily ZAK-4 Crypto index calculation (from January 1, 2018, to April 1, 2018)

| Crypto | Bitcoin (BTC) | Ethereum (ETH) | Bitcoin Cash (BCH) | Ripple (XRP) | 4 Crypto | ||||||||||

| Price Open | Volume (24h) | Market cap | Price Open | Volume (24h) | Market cap | Price Open | Volume (24h) | Market cap | Price Open | Volume (24h) | Market cap | Volume (24h) 4 crypto | Market cap 4 crypto | ZAK-4 Crypto index | |

| Date | $ | USD billion | USD billion | $ | USD billion | USD billion | $ | USD billion | USD billion | $ | USD billion | USD billion | USD billion | USD billion | % |

| Apr 1, 2018 | 7 003 | 4.5 | 118.7 | 397 | 1.3 | 39.1 | 688 | 0.3 | 11.7 | 0.51 | 0.3 | 20.1 | 6.4 | 189.7 | 3.4% |

| Mar 25, 2018 | 8 613 | 4.6 | 145.9 | 523 | 1.2 | 51.4 | 974 | 0.2 | 16.6 | 0.64 | 0.2 | 25.0 | 6.2 | 238.9 | 2.6% |

| Mar 18, 2018 | 7 891 | 6.6 | 133.5 | 552 | 2.7 | 54.2 | 948 | 0.4 | 16.1 | 0.63 | 0.9 | 24.8 | 10.7 | 228.7 | 4.7% |

| Mar 11, 2018 | 8 853 | 6.3 | 149.7 | 685 | 1.6 | 67.2 | 1 003 | 0.5 | 17.1 | 0.80 | 0.5 | 31.1 | 8.8 | 265.1 | 3.3% |

| Mar 4, 2018 | 11 497 | 6.1 | 194.3 | 856 | 1.7 | 83.9 | 1 268 | 0.4 | 21.6 | 0.91 | 0.8 | 35.4 | 8.9 | 335.1 | 2.7% |

| Mar 1, 2018 | 10 385 | 7.3 | 175.4 | 856 | 1.9 | 83.8 | 1 205 | 0.5 | 20.5 | 0.90 | 0.5 | 35.3 | 10.1 | 315.1 | 3.2% |

| Feb 25, 2018 | 9 796 | 5.7 | 165.4 | 839 | 1.6 | 82.1 | 1 191 | 0.4 | 20.2 | 0.95 | 0.4 | 37.2 | 8.1 | 305.0 | 2.6% |

| Feb 18, 2018 | 11 123 | 8.7 | 187.7 | 973 | 2.6 | 95.1 | 1 552 | 0.9 | 26.3 | 1.20 | 1.1 | 47.0 | 13.3 | 356.1 | 3.7% |

| Feb 11, 2018 | 8 616 | 6.1 | 145.2 | 859 | 2.5 | 83.8 | 1 256 | 0.7 | 21.3 | 1.07 | 2.6 | 41.6 | 11.8 | 292.0 | 4.0% |

| Feb 4, 2018 | 9 176 | 7.1 | 154.6 | 965 | 3.0 | 94.0 | 1 273 | 0.7 | 21.6 | 0.91 | 1.2 | 35.6 | 11.9 | 305.7 | 3.9% |

| Feb 1, 2018 | 10 237 | 10.0 | 172.4 | 1 119 | 5.3 | 109.0 | 1 491 | 0.7 | 25.3 | 1.16 | 1.4 | 45.0 | 17.3 | 351.6 | 4.9% |

| Jan 28, 2018 | 11 475 | 8.4 | 193.1 | 1 112 | 5.4 | 108.1 | 1 636 | 0.6 | 27.7 | 1.22 | 1.3 | 47.4 | 15.6 | 376.4 | 4.2% |

| Jan 21, 2018 | 12 889 | 9.9 | 216.7 | 1 156 | 3.4 | 112.2 | 2 034 | 0.7 | 34.4 | 1.58 | 2.8 | 61.1 | 16.9 | 424.4 | 4.0% |

| Jan 14, 2018 | 14 371 | 11.1 | 241.4 | 1 397 | 4.8 | 135.5 | 2 687 | 1.0 | 45.4 | 2.02 | 2.0 | 78.2 | 18.9 | 500.6 | 3.8% |

| Jan 7, 2018 | 17 527 | 15.9 | 294.2 | 1 043 | 5.6 | 101.0 | 2 785 | 1.4 | 47.1 | 3.09 | 2.4 | 119.8 | 25.3 | 562.1 | 4.5% |

| Jan 1, 2018 | 14 112 | 10.3 | 236.7 | 756 | 2.6 | 73.1 | 2 535 | 0.9 | 42.8 | 2.30 | 1.9 | 88.9 | 15.7 | 441.6 | 3.6% |

* Data as of April 1, 2018, 00:00 UTC

** Data source: coinmarketcap.com

Table 1.4 shows events that took place in the beginning of 2018 and had an impact on both the prices of the dominant cryptocurrencies and the market in general, with an indication of their nature and type of impact.

Table 1.4. Key events of the week having an influence on cryptocurrency prices, January-March 2018

| № | Factors and events

(link to source) |

Date of news | Description | Nature of impact | Type of impact |

| 1. | Crypto Market Capitalization Surpasses $700B, Bitcoin Dominance Drops to Record Low [source: Coinspeaker] | January 3, 2018 | The new record level of cryptocurrency market capitalization shows that the market may continue its growth trend and we may see even larger numbers in 2018. Subsequent growth equaled up to $830 billion over four days. | Market ⇑

|

Favorable |

| 2. | Indian Banks are Choking Bitcoin Exchanges by Blocking Payments and Withdrawals [source: Qz.com] | January 9, 2018 | Stricter control of the National Bank over the crypto industry is forcing large Indian banks to stop servicing cryptoexchanges. This is bad news for the crypto industry, as the Indian government is in a serious mood and wants to take the crypto industry under its control. | Market ⇓

|

Unfavorable |

| 3. | Staff Letter: Engaging on Fund Innovation and Cryptocurrency-Related Holdings [source: Sec.gov] | January 19, 2018 | The clearly negative attitude of the US Securities and Exchange Commission to ETF bitcoin derivatives due to the excessive volatility of cryptocurrencies is visible in its published letter. | Market ⇓ | Unfavorable |

| 4. | Japanese Cryptocurrency Exchange Loses More Than $500 Million to Hackers [source: CNBC] | January 26, 2018 | The market fell drastically after the notorious hack of the first cryptoexchange Mt. Gox and the theft of nearly $400 million in 2014. The crypto industry is much bigger now than it was in 2014, but this was still very bad news and led to a slight downward adjustment. | Market ⇓ | Unfavorable |

| 5. | Facebook is Banning All Ads Promoting Сryptocurrencies and ICOs [source: Coinspeaker] | January 31, 2018 | Facebook has banned all advertising related to the crypto industry, including ICOs, bitcoin and Ethereum. This is bad news for the market, since many still associate cryptocurrencies with high risks. | Market ⇓ | Unfavorable |

| 6. | Bitcoin Price Drops Below $7,000 as China Blocks Access to Foreign Crypto Exchanges [source: Coinspeaker] | February 6, 2018 | China has banned the use of foreign cryptocurrency exchanges, which will lead to the complete isolation of Chinese traders and have an adverse effect on the entire market. | Market ⇓

|

Unfavorable |

| 7. | Dubai Trader Gets First Mideast License in Cryptocurrencies [source: Bloomberg] | February 13, 2018 | The government of yet another country reacts positively to the development of the crypto industry. This is the first official permit for trading in cryptocurrencies in the Middle East. | Market ⇑

|

Favorable |

| 8. | Coinbase And Bitfinex Integrate Bitcoin Scaling Upgrade SegWit [source: Cointelegraph] | February 20, 2018 | This is good news for bitcoin, as the scalability problem may be partially resolved thanks to integration of SegWit, which would lead to a reduction in transaction fees in the bitcoin network. This could have a positive impact on the market as a whole. | Market ⇑

BTC ⇑

|

Favorable |

| 9. | Commission to Host a Roundtable on Cryptocurrencies [source: Europa.eu] | February 26, 2018 | The general tone of the meeting was quite positive, as the members of the Commission discussed the potential importance of blockchain for the future of financial markets. However, at the end of the meeting it was emphasized that one should not forget about the risks inherent in cryptocurrencies. | Market ⇑ | Favorable |

| 10. | Mt. Gox Trustee Unloads Bitcoin and Bitcoin Cash Holdings Worth $400 Million [source: Coinspeaker] | March 8, 2018 | Japanese lawyer Nobuaki Kobayashi, who is acting as the trustee of the Mt. Gox exchange which went bankrupt in 2014, has sold the $400 million in bitcoins belonging to the exchange to settle obligations to creditors. He also announced that he intends to continue selling the cryptoexchange’s digital assets worth a total of $1.8 billion. | BTC ⇓

Market ⇓ |

Unfavorable |

| 11. | ‘Cryptocurrencies Don’t Pose Risks to Financial Stability,’ Says G20 Watchdog Mark Carney [source: Coinspeaker] | March 19, 2018 | On the eve of the G20 summit in Buenos Aires, the head of an international group of central bank regulators that coordinates the financial regulation of the G20 announced that cryptocurrencies do not pose risks to global financial stability. | Market ⇑ | Favorable |

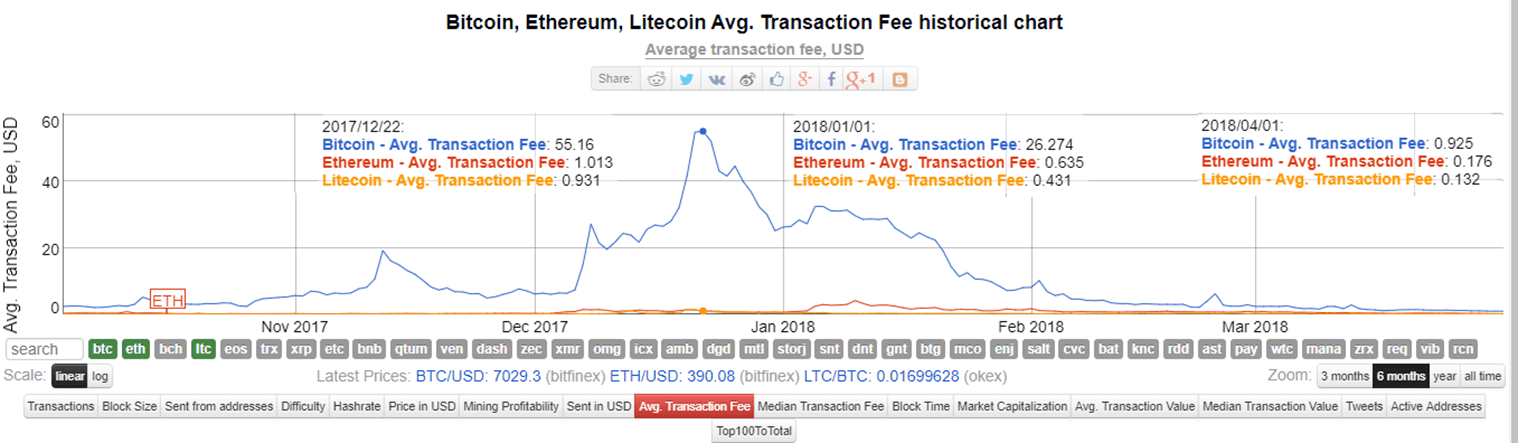

For the most part, the events of January-March were negative in nature, which led to a significant reduction in cryptocurrency market capitalization during the first quarter of 2018. However, the cost of a bitcoin transactions fell considerably. After the implementation of network scalability solutions such as SegWit and Lightning, the capabilities of the bitcoin blockchain will increase significantly.

In December 2017 transaction fees had reached $55, in the beginning of 2018 they equaled $26, and on April 1, 2018, they were already less than $1 (see fig. 3). This reduction is due to the fall in the number of transactions in the network and the SegWit integration. Specifically, in February Coinbase and Bitfinex announced the SegWit integration. All these factors had a positive effect on the cost of bitcoin transactions.

Figure 3. Bitcoin, Ethereum and Litecoin transaction fees

Data source: bitinfocharts.com

Table 1.5 gives a list of events, information on which appeared last week, which could impact both the prices of specific cryptocurrencies and the market in general.

Table 1.5. Events that could have an influence on cryptocurrency prices in the future

|

№ |

Factors and events

(link to source) |

Date of news | Description | Nature of impact | Type of impact |

| 1. | A Simple and Principled Way to Compute Rent Fees [source: Ethresear.ch] | March 28, 2018 | The creator of Ethereum, Vitalik Buterin, has proposed that a so-called “rent fee” be charged for use of the Ethereum network, the amount of which would depend on the duration of blockchain storage of data. In this way, Ethereum would be able to manage the growing number of platform users and the amount of data | Market

ETH |

Unfavorable |

| 2. | Bitfinex Plans to Move to Switzerland [source: Handelszeitung.ch] | March 29, 2018 | Bitfinex, the fifth largest cryptocurrency exchange in the world in terms of trading volume, is planning to move to the Swiss city of Zug | Market ⇑ | Favorable |

| 3. | Intel Developing Bitcoin Mining Hardware Accelerator [source: Appft.uspto.gov] | March 30, 2018 | Technology giant Intel is working on a bitcoin mining hardware accelerator, which will make it possible to lower energy costs during mining of bitcoin and other cryptocurrencies | Market ⇑

BTC ⇑ |

Favorable |

1.2 Market trends

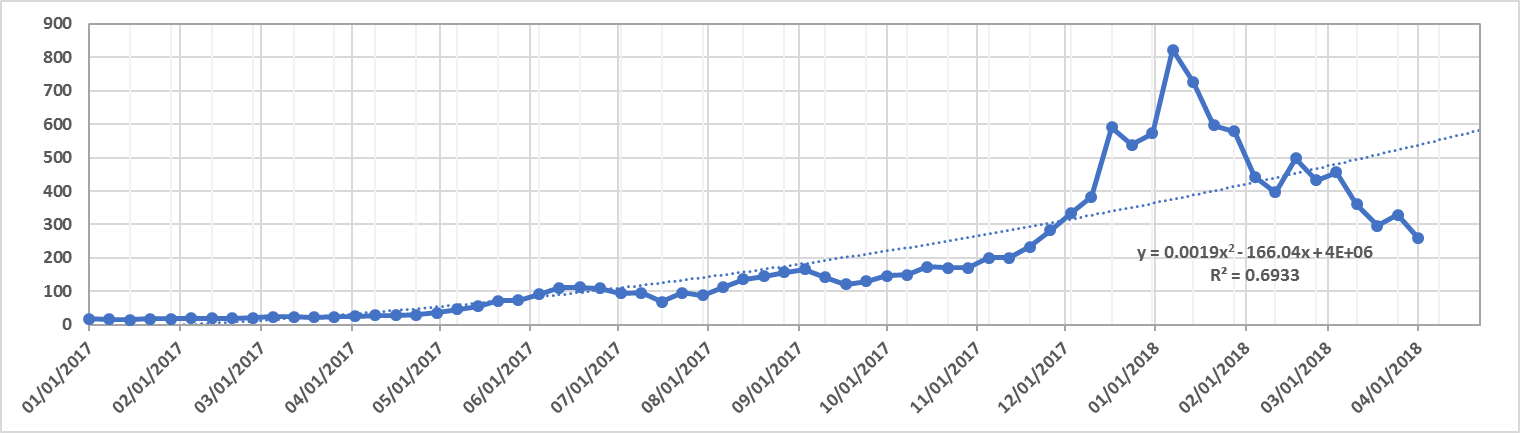

The weekly cryptocurrency and digital asset market trends from October 1, 2017, to April 1, 2018, are presented as graphs (Fig. 1.1-1.5)*.

Table 1.6. Legends and descriptions of the graphs

| Global Figures | Figure** | Description |

| Total cryptocurrency market capitalization, USD million | Fig. 1.1 | This figure shows cryptocurrency and digital asset market capitalization trends from October 1, 2017. |

| The rate of market change (as a % to the beginning of 2017) | Fig. 1.1 | This figure shows the % change in cryptocurrency and digital asset market capitalization compared to January 1, 2017. |

| Change in the market capitalization (in USD million compared to previous period) | Fig. 1.2 | This figure shows the weekly change in USD million (increase or decrease) in cryptocurrency and digital asset market capitalization from October 1, 2017. |

| The rate of market change (as a % compared to the previous period) | Fig. 1.2 | This figure shows the % of weekly change (increase or decrease) in cryptocurrency and digital asset market capitalization from October 1, 2017. |

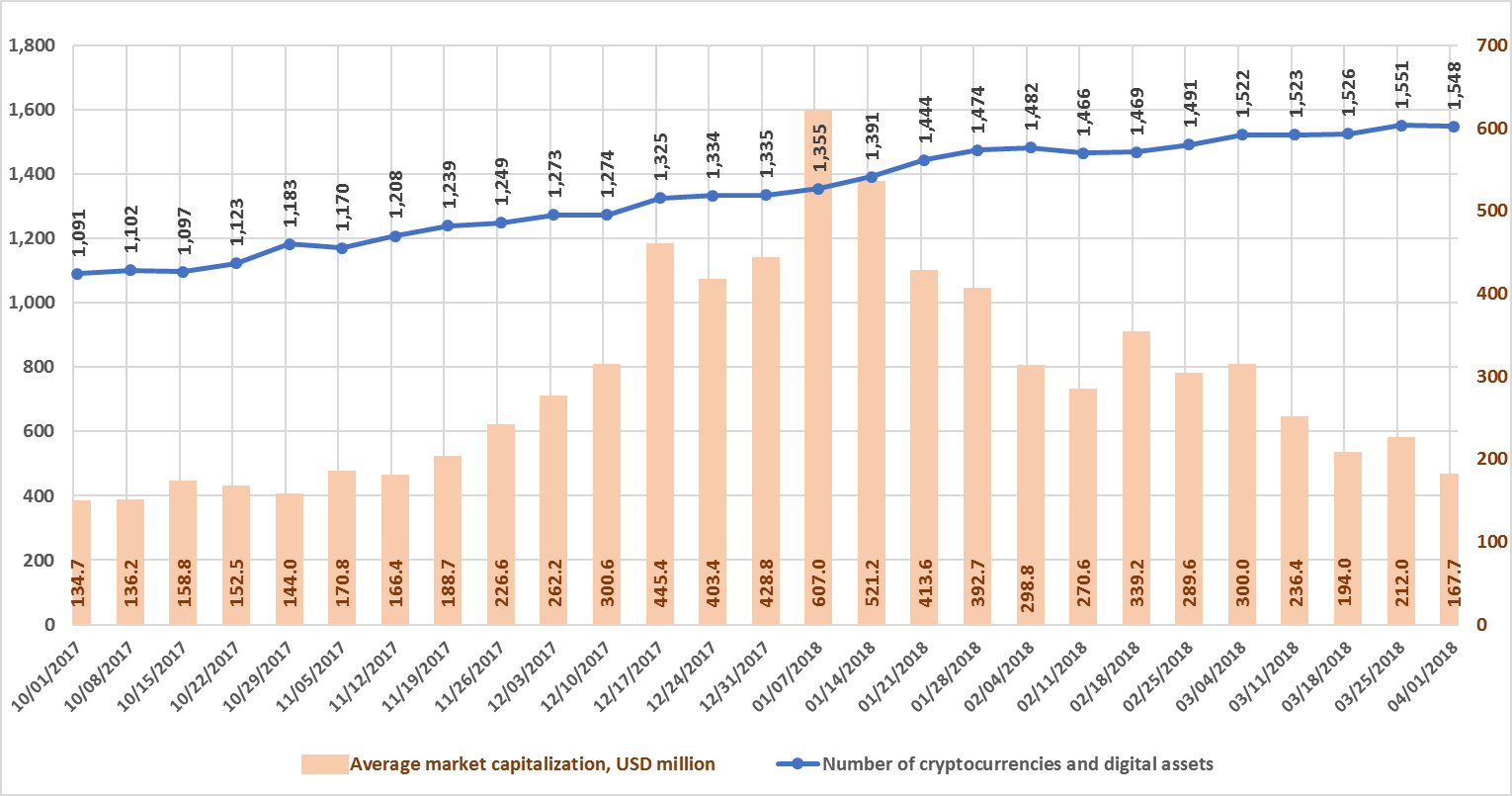

| Number of cryptocurrencies and digital assets | Fig.1.3 | This figure shows the trends in the increase of the number of cryptocurrencies and digital assets circulating on cryptocurrency exchanges. On January 1, 2017, their number was 617, and as of April 1, 2018, this number had already reached 1,548. |

| Average market capitalization, USD million | Fig. 1.3 | This figure reflects the growth in the average cryptocurrency and digital asset market capitalization from October 1, 2017, i.e. the ratio between the market capitalization of all cryptocurrencies and digital assets and their number. |

| Forecast of total cryptocurrency market capitalization | Fig. 1.4, 1.5 | This figure shows the time trend (forecast) change in cryptocurrency and digital asset market capitalization. |

* Data as of April 1, 2018, 00:00 UTC

** NB! Average daily data are given in the graphs below. For this reason, the figures in the graphs may differ from the data in Table 1.1, where all figures were calculated at 03:00 UTC.

These differences in the values may be significant during periods of high cryptocurrency market volatility.

Data source: coinmarketcap.com

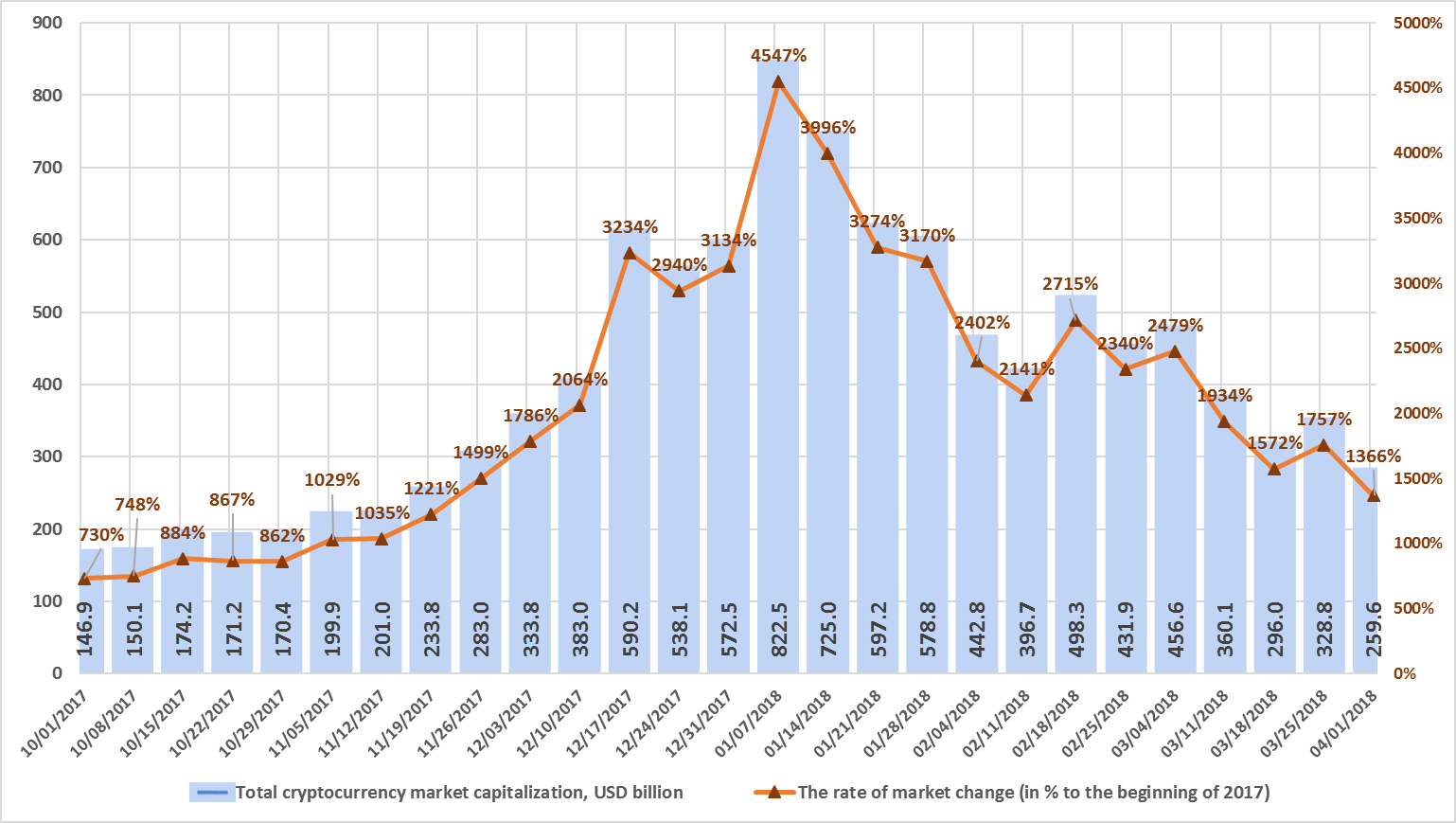

Figure 1.1. Total cryptocurrency market capitalization*

* Average daily data (according to the data of coinmarketcap.com).

Figure 1.1 shows a graph of the weekly cryptocurrency market change from October 1, 2017, to April 1, 2018. Over this period, market capitalization increased from $146.9 billion to $259.6 billion, a growth of 1,366% compared to the start of 2017. Therefore, everyone who entered the cryptocurrency market in early 2017 was able to receive high returns due to market growth. However, the fall over the period since January 7, 2018, has equaled more than $550 billion. Last week (March 26-April 1, 2018) cryptocurrency market capitalization decreased from $328.8 billion to $259.6 billion (as of April 1, 2018, based on the average figures from coinmarketcap.com).

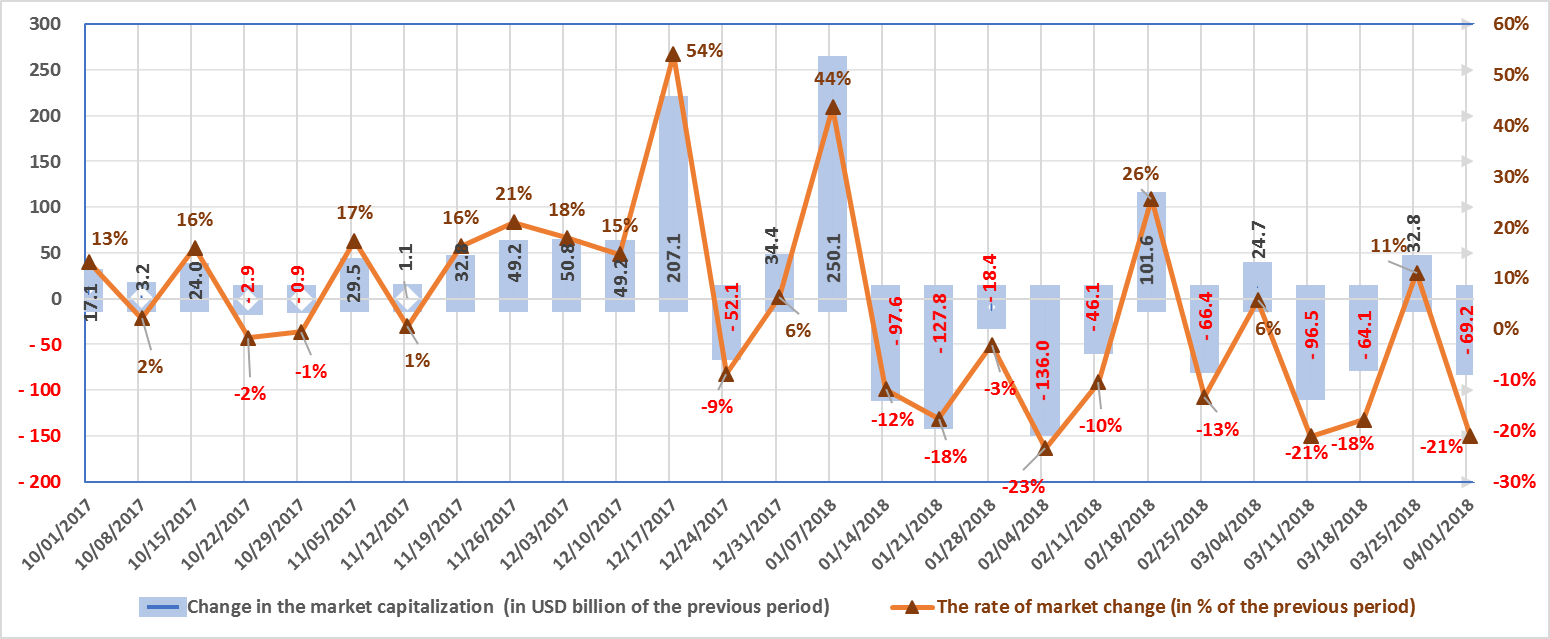

Figure 1.2. Change in market capitalization

The market is susceptible to sudden and drastic fluctuations. The highest growth rate in Q4 2017 (December 17-24, 2017) was around $200 billion, or 54%. During the first week of January, market capitalization increased by approximately $250 billion, or 44%.

Nine out of the thirteen weeks in Q1 2018 have been “in the red”, i.e. capitalization fell based on the results of each of these weeks. Last week the market fell by another $69.2 billion, or 21% (with due account of average daily data, see fig. 1.2).

Figure 1.3. Number of cryptocurrencies and digital assets

Data source: coinmarketcap.com

Since the beginning of October 2017, the total number of cryptocurrencies and digital assets considered when calculating market capitalization has increased from 1,091 to 1,548. Based on the data of coinmarketcap.com, their number decreased by 3 from 1,551 to 1,548 over the last week, and average capitalization decreased to $167.7 million. Over the past month, 60 new coins and tokens have appeared on coinmarketcap.com, but it should be noted that a number of other coins and tokens were also excluded from the list.

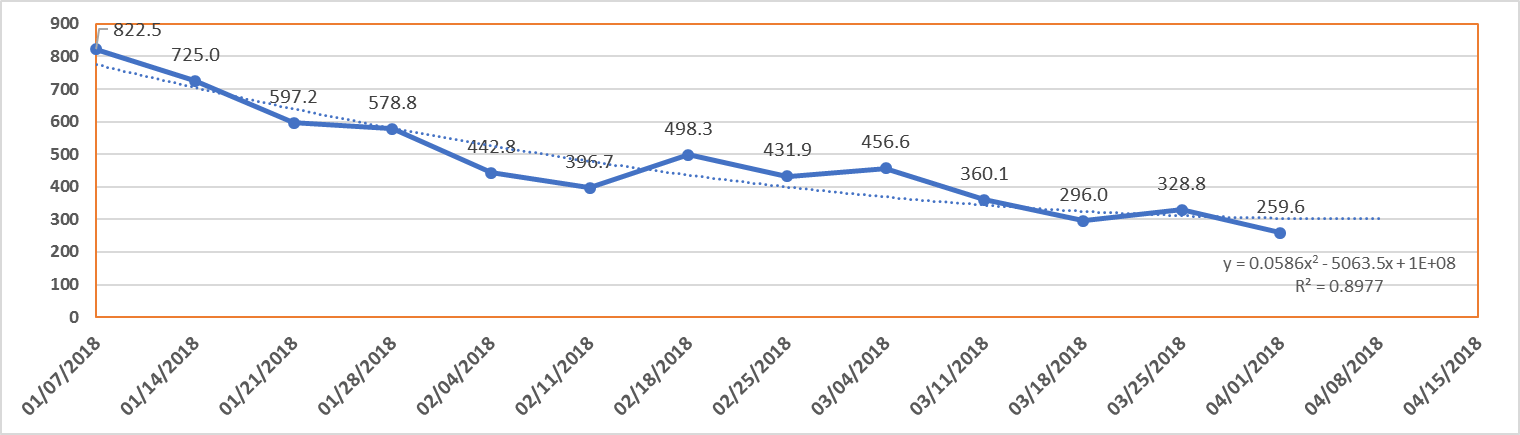

Figures 1.4 and 1.5. Forecast of total cryptocurrency market capitalization

In general, the first quarter of 2018 can be considered a trying time for the cryptocurrency market. Beginning with the second week of January, the market has been experiencing dramatic drops with gradual partial recovery. Most news events related to the cryptocurrency market have had a negative tone, and have led to a more than threefold fall in capitalization compared to the maximum level on January 7, 2018, i.e. from $830 billion to $240 billion. The hype that existed at the end of 2017 has passed.

The actions of the regulators of various countries sometimes have diametrically opposed impact (from a ban to full legalization). In China and South Korea, the intentions and decisions taken for the different areas of regulation (exchanges, ICOs, mining, trading) range from permission to a ban. The only thing that does not cause doubt and apprehension is blockchain, which is recognized by nearly all institutions and countries as an area that needs to be developed.

Despite the across-the-board fall in the market and the appearance of numerous new coins and tokens during the first quarter of 2018, bitcoin has strengthened its position, with its dominance increasing from 38.6% to 45%.

Annex – Glossary

| Key terms | Definition |

| Market capitalization | Value of an asset calculated based on its current market (exchange) price. This economic indicator is used to assess the total aggregate value of market instruments, players, and markets. [Source: https://en.wikipedia.org]. |

| Cryptocurrency market capitalization | The market value of an individual coin or token circulating on the market. |

| Total cryptocurrency market capitalization | The market capitalization of cryptocurrencies and digital assets, i.e. the aggregate market value of cryptocurrencies and digital assets (coins and tokens) circulating on the market. |

| Dominance | Market share, i.e. the ratio of market capitalization of a particular cryptocurrency (coin, token) to total cryptocurrency market capitalization. Expressed as a %. |

| Not Mineable

|

A coin that is not mineable. The term is used for cryptocurrencies (coins, tokens) which cannot be mined or issued through mining. |

| Pre-mined | A pre-mined coin. The term is used for cryptocurrencies (coins, tokens) which are issued through mining, and a certain number of coins (tokens) have been created and distributed among certain users at the start of the project. |

| The rate of market increase (as a % compared to the beginning of the year) | The rate of market increase (as a % compared to the start of the year), i.e. by how many % points did market capitalization increase compared to the start of the year. |

| The growth rate of the market (as a % to the beginning of the year) | The rate of market growth (as a % compared to the start of the year), i.e. by how many times did market capitalization grow compared to the start of the year. |

| Increase in market capitalization (in USD million compared to the previous period) | Increase in cryptocurrency and digital asset market capitalization (in USD million compared to the previous period), i.e. by how many USD million did market capitalization increase over the period. |

| The rate of market increase (as a % compared to the previous period) | The rate of market increase (as a % compared to the previous period), i.e. by how many % points did market capitalization increase over the period. |

| The market growth rate (as a % compared to the previous period) | The market growth rate (as a % compared to the previous period), i.e. by how many times did market capitalization grow compared to the previous period. |

| Number of cryptocurrencies and digital assets | Number of cryptocurrencies and digital assets. At the beginning of 2018 over 1,300 cryptocurrencies and digital assets (coins and tokens) were circulating on the market. |

| Average market capitalization | Average market capitalization, i.e. the ratio of the market capitalization of all cryptocurrencies and digital assets to their number. |

| ZAK-n Crypto index | The index is calculated as a percentage and represents a ratio between the trading volume (transactions) on cryptocurrency exchanges per day (Volume 24h) for n dominant cryptocurrencies to their total market capitalization.

ZAK-4 Crypto index calculations include four dominant cryptocurrencies with the greatest market capitalization: Bitcoin, Ethereum, Bitcoin Cash, and Ripple. ZAK-8 Crypto index calculations include the trading volume and market capitalization for eight cryptocurrencies. |

The post Quarterly Cryptocurrency Market Analysis [Q1 2018] appeared first on CoinSpeaker.