Quarterly ICO Market Analysis [Q1 2018]

Information as of April 2, 2018

This report was created by:

- Professor Dmitrii Kornilov, Doctor of Economics, Member of the Russian Academy of Natural Sciences, and Leading Analyst at ICOBox;

- Dima Zaitsev, PhD in Economics, Head of International Public Relations and Business Analytics Department Chief at ICOBox;

- Nick Evdokimov, Co-Founder of ICOBox;

- Mike Raitsyn, Co-Founder of ICOBox;

- Anar Babaev, Co-Founder of ICOBox;

- Daria Generalova, Co-Founder of ICOBox

This report presents data on ICO market changes during 2017-2018. Special emphasis has been placed on an analysis of the changes that took place in the first quarter of 2018, including over the last week (March 26-April 1, 2018).

1. General analysis of the ICO market (by quarter, month, week)

While 2017 was repeatedly called the year of the cryptocurrency, 2018 may well qualify as the year of the ICO. The first quarter of 2018 has been extraordinarily successful from the standpoint of collection of funds. Right now, based on preliminary assessments, it can be said that more than $7.4 billion has already been collected, which is more than during all of 2017, and this despite a threefold fall in the entire cryptocurrency market over the first quarter. The total funds collected in 2017 equaled around $6.9 billion.

The growth in collected funds in 2018 took place despite the introduction of a number of changes and restrictions in this area related to regulation processes and the types of tokens being issued (for example, regulation of the issue of tokens by the US Securities and Exchange Commission (SEC) and restrictions on security tokens).

Despite the ban on initial coin offerings in certain countries (China, South Korea), and the need to perform KYC (Know Your Customer) verification procedures, some ICO projects have established mandatory preregistration, limitations on the minimum and maximum amount of tokens purchased, a digital queue for the right to purchase tokens, etc.

1.1. Brief overview of ICO market trends

Table 1.1. Brief ICO market overview, key events, news for the first quarter of 2018

| № | Factors and events

(link to source) |

Date of news | Description | Type of impact |

| 1. | Kodak to Launch Major Blockchain Initiative and Cryptocurrency ‘KodakCoin’ [source: Coinspeaker] | January 10, 2018 | The CEO of Kodak has announced that the company is planning to create its own blockchain platform, which will help solve one of the main problems in the photo industry, that of licensing. | ICO ⇑

Favorable |

| 2. | A Major California City Could Become the First to Create its Own Bitcoin-Inspired Currency [source: uk.businessinsider.com] | February 6, 2018 | Berkeley may become the first city in the USA to hold its own ICO to collect funds and thereby reduce its dependence on the federal budget and the Trump administration. | ICO ⇑

Favorable |

| 3. | FINMA Publishes ICO Guidelines [source: Finma.ch] | February 16, 2018 | The goal of this document is to facilitate the development of the blockchain industry in the country and give some sort of regulatory clues to companies planning to use this method to collect funds. The document has a positive effect on the atmosphere for creating new blockchain projects and may significantly increase growth rates. | ICO ⇑

Favorable |

| 4. | Durov Brothers File Telegram And TON With SEC, Report $850 Million Already Raised [source: Cointelegraph] | February 17, 2018 | The large TON ICO project has filed an application in the US Securities and Exchange Commission stating that it has already collected $850 million. This is one of only a few ICOs that has taken this step. This shows that more creators of ICOs are willing to contact and work according to the rules of the financial regulators, which is very good for all ICO market participants as the risks of being deceived are reduced. | ICO ⇑

Favorable |

| 5. | German Regulator Clarifies Obligations For ICO Operators Following Increased Interest [source: Cointelegraph] | February 20, 2018 | The German regulator BaFin has issued a list of requirements on ICO tokens and clarified the situation regarding the law to which tokens are subject. | ICO ⇑

Favorable |

| 6. | Venezuela Launches Presale of State-Backed ‘Petro’ Cryptocurrency [source: Ft.com] | February 20, 2018 | Venezuela has begun its ICO and launched the presale of its national oil-backed cryptocurrency after all. According to Nicolas Maduro’s Twitter account, $735 million were collected on the first day of the presale. | ICO ⇑

Favorable |

| 7. | One Day After Petro Went Live, Venezuela Introduces New ‘Petro Gold’ Token [source: Coinspeaker] | February 22, 2018 | Nicolas Maduro has announced the creation of another cryptocurrency, this time one backed by gold. | Uncertain |

| 8. | Cryptocurrency Firms Targeted in SEC Probe [source: Wsj.com] | February 28, 2018 | Over the past few weeks some ICOs have received subpoenas from the SEC concerning the structure of their presale or main ICO, and on February 28 an investigation was launched into these ICOs. This means that a series of fines and punishments may soon follow. | ICO ⇓

Unfavorable |

| 9. | South Korea is Planning to Allow ICOs with New Regulations, Says New Report [source: Coinspeaker] | March 13, 2018 | The relevant South Korean authorities are considering the possibility of lifting the ban on participation in ICOs for the country’s citizens. | ICO ⇑

Favorable |

Table 1.2 shows the data for 2017 and development trends on the ICO market since the start of 2018. Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered.

Table 1.2. Aggregated trends and performance indicators of past (completed) ICOs1,2

| Indicator | 2017 | January

2018 |

February

2018 |

March

2018 |

| Total amount of funds collected, USD million | 6 890.1 | 1 665 | 2 732 | 3 004.2 |

| Number of companies that completed an ICO1 | 514 | 96 | 100 | 89 |

| Maximum collected, USD million (ICO name) | 258

(Hdac) |

100

(Envion) |

850

(Pre-ICO-1 TON) |

850

(Pre-ICO-2 TON) |

| Average collected funds, USD million | 13.4 | 17.3 | 27.3 | 33.8 |

Note:

1 Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com. For some ICOs information may currently be incomplete (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

2 Including the TON Pre-ICO-1&2, and Petro Pre-ICO

3 The data for 2018 have been updated (date updated: April 1, 2018).

The data for the first quarter of 2018 were adjusted to account for the appearance of more complete information on past ICOs. The amount of funds collected via ICOs during the past week (March 26-April 1, 2018) equaled $1,198.4 million. This amount consists of the results of 30 successfully completed ICOs, with the largest amount of funds collected equaling $850 million (TON Pre-ICO-2) (see Table 1.4).

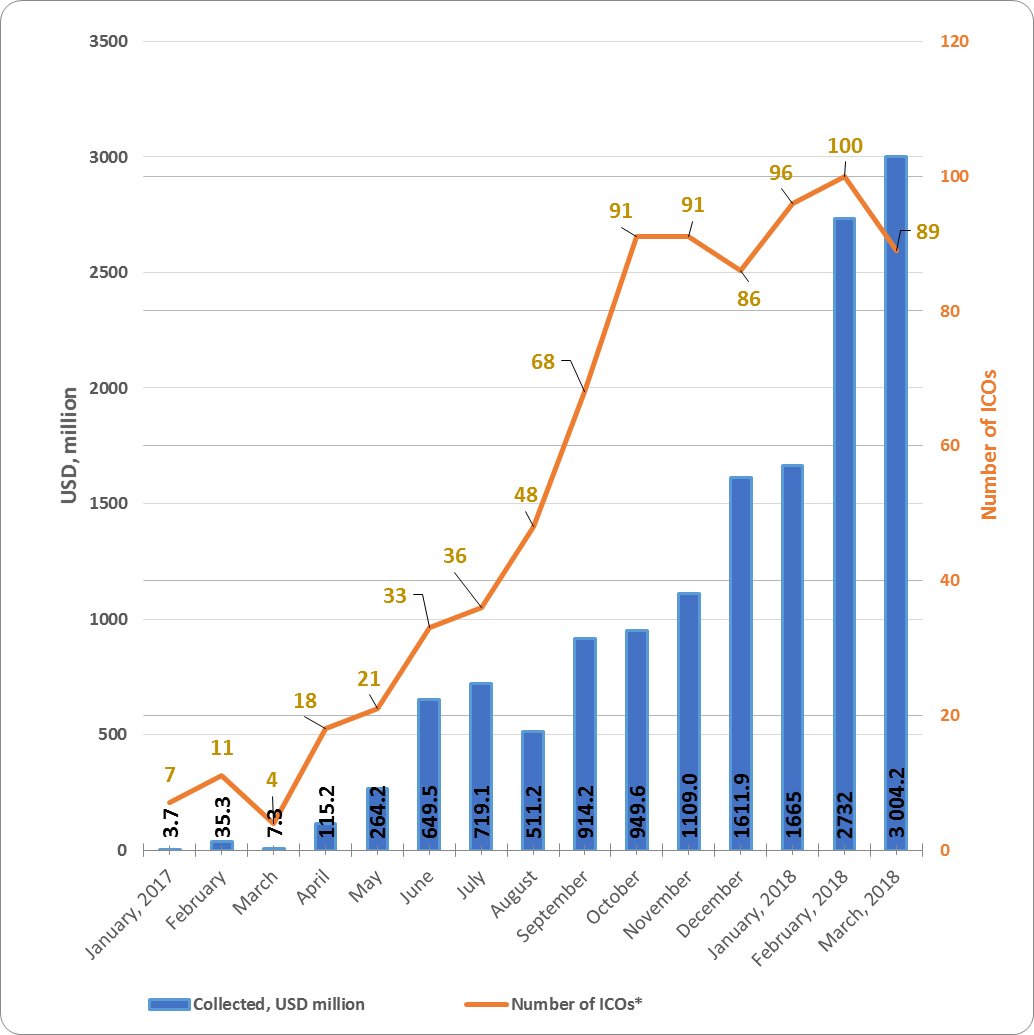

Table 1.3. Amount of funds collected and number of ICOs

| Month | Collected,

$ million |

Number of ICOs* | Average collected,

$ million |

| January 2017 | 3.7 | 7 | 0.53 |

| February | 35.3 | 11 | 3.21 |

| March | 7.3 | 4 | 1.82 |

| April | 115.2 | 18 | 6.4 |

| May | 264.2 | 21 | 12.58 |

| June | 649.5 | 33 | 19.68 |

| July | 719.1 | 36 | 19.97 |

| August | 511.2 | 48 | 10.65 |

| September | 914.2 | 68 | 13.44 |

| October | 949.6 | 91 | 10.44 |

| November | 1 109 | 91 | 12.19 |

| December | 1 611.9 | 86 | 18.74 |

| Total, 2017 | 6 890.1 | 514 | 13.4 |

| January 2018 | 1 665 | 96 | 17 |

| February 2018 | 2 732 | 100 | 27.3 |

| March 2018 | 3 004.2 | 89 | 33.8 |

| Total for Q1

2018*** |

7401.1 | 285 | 26.0 |

* Data source: tokendata.io, icodrops.com, icodata.io, coinschedule.com, cryptocompare.com, smithandcrown.com.

Information on funds collected is not available for all ICOs (information for last week is tentative and may be adjusted). ICOs that collected less than $100,000 were not considered.

** More than 1,000 ICOs were performed in 2017. However, the data for the 514 largest and most popular ICOs, the data of which can be processed, were considered when calculating the total amount of funds collected during 2017 (data updated: April 1, 2018).

*** Including the TON Pre-ICO-1&2 and the Petro presale

Table 1.3 shows that the largest amount of funds was collected via ICOs in February 2018. The highest average collected funds per ICO was also seen in February 2018.

Figure 1.1. Trends in funds collected and number of ICOs since the start of 2017

1.2. Top ICOs of last week

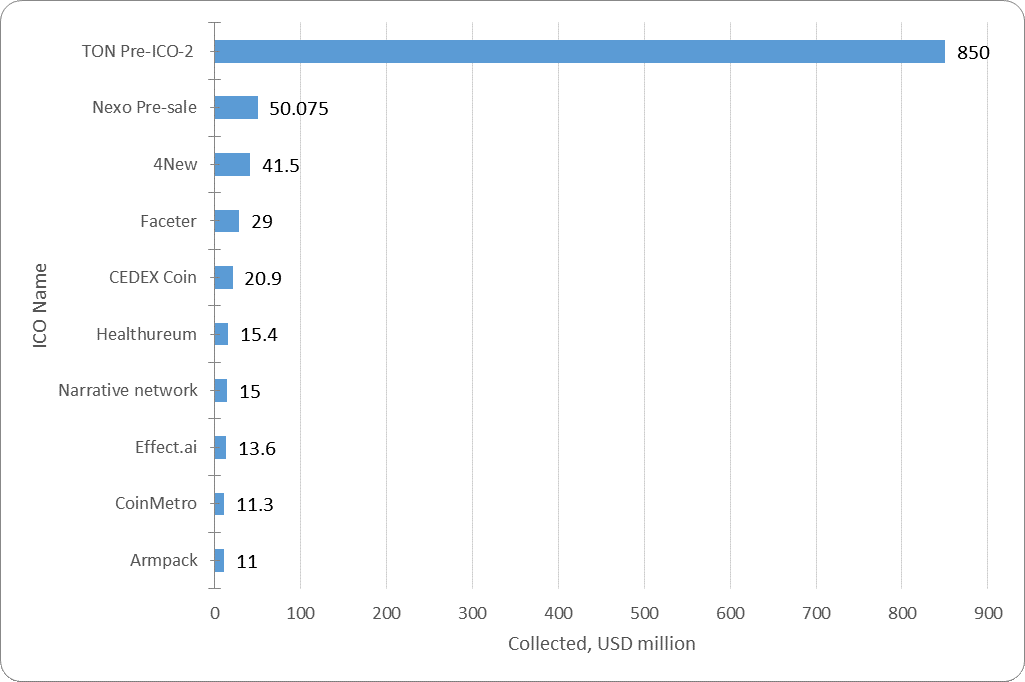

Table 1.4 shows the ten largest ICOs of the week.

Table 1.4. Top 10 ICOs in terms of the amount of funds collected (March 26-April 1, 2018)*

| № | Name of ICO*** | Category** | Collected, $ million | Date |

| 1 | TON Pre-ICO-2 | Infrastructure | 850 | March 2018 |

| 2 | Nexo Pre-sale | Finance | 50.075 | April 1, 2018 |

| 3 | 4New | Energy & Utilities | 41.5 | March 31, 2018 |

| 4 | Faceter | Machine Learning & AI | 29 | March 30, 2018 |

| 5 | CEDEX Coin | Trading & Investing | 20.9 | March 26, 2018 |

| 6 | Healthureum | Drugs & Healthcare | 15.4 | April 1, 2018 |

| 7 | Narrative network | Social Network | 15 | March 29, 2018 |

| 8 | Effect.ai | Machine Learning & AI | 13.6 | March 28, 2018 |

| 9 | CoinMetro | Trading & Investing | 11.3 | March 31, 2018 |

| 10 | Armpack | Infrastructure | 11 | April 1, 2018 |

| Top 10 ICOs* | 1 057 | |||

| Total funds collected from March 26-April 1, 2018 (30 ICOs)* | 1 146 | |||

| Average funds collected | 38.2 |

* When compiling the lists of top ICOs, information from the websites tokendata.io, icodrops.com, icodata.io, coinschedule.com and other specialized sources is used.

** The category was established based on expert opinions.

*** Only popular and/or successfully completed ICOs (i.e. ICOs which managed to collect the minimum declared amount of funds) and/or ICOs listed on exchanges were considered. Information may be incomplete for some ICOs (for instance, the amount of funds collected). ICOs that collected less than $100,000 were not considered.

The data for last week (March 26-April 1, 2018) may be adjusted as information on the amounts of collected funds by completed ICOs is finalized.

The leader for the week was the TON Pre-ICO-2 project. In total the project has already collected $850 million twice. The TON blockchain is a scalable and flexible blockchain architecture that makes it possible to process millions of transactions per second, i.e. a sort of alternative to VISA / Mastercard for the new decentralized economy. It is assumed that the Platform (TON) will include: Data storage, Simple wallets, integration with the Telegram Messenger and much more.

Figure 1.2 presents the ten largest ICOs completed last week.

Figure 1.2. Top 10 ICOs in terms of the amount of funds collected (March 26-April 1, 2018)

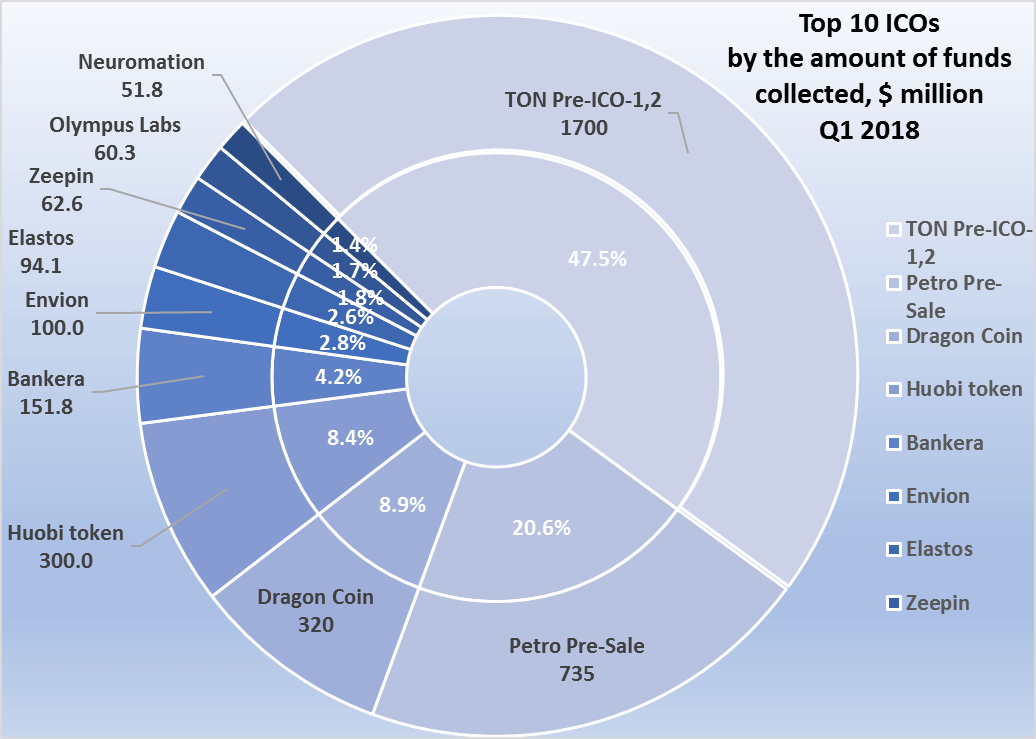

1.3 Top ICOs in Q1 2018

Table 1.5. Top 10 ICOs in terms of the amount of funds collected in Q1 2018

| Name of ICO | Category | Collected, $ million | % | Completed | |

| 1 | TON Pre-ICO-1,2 | Infrastructure | 1700 | 47.5% | February-March 2018 |

| 2 | Petro Pre-Sale | Commodities | 735 | 20.6% | March 19, 2018 |

| 3 | Dragon Coin | Gambling & Betting | 320 | 8.9% | March 15, 2018 |

| 4 | Huobi token | Finance | 300.0 | 8.4% | February 28, 2018 |

| 5 | Bankera | Finance | 151.8 | 4.2% | February 28, 2018 |

| 6 | Envion | Mining | 100.0 | 2.8% | January 15, 2018 |

| 7 | Elastos | Infrastructure | 94.1 | 2.6% | January 23, 2018 |

| 8 | Zeepin | Data storage | 62.6 | 1.8% | January 18, 2018 |

| 9 | Olympus Labs | Finance | 60.3 | 1.7% | January 14, 2018 |

| 10 | Neuromation | Data Storage | 51.8 | 1.4% | January 7, 2018 |

| Total, Top 10 | 3575.6 | 100% |

* The category was established based on expert opinions.

** When compiling the lists of top ICOs, information from the websites tokendata.io, coinschedule.com and other specialized sources is used. The category of ICO projects corresponds to information from the coinschedule.com website.

*** Data source for the Petro presale – http://www.elpetro.gob.ve

Table 1.5 shows the top 10 largest ICOs in terms of the amount of funds collected, most of which belong to the categories Infrastructure, Finance and Commodities.

Figure 1.3. Top 10 ICOs in terms of the amount of funds collected in Q1 2018

Last week (March 26-April 1, 2018) at least 30 ICO projects were successfully completed, each of which collected more than $100,000, with the total amount of funds collected equaling around $1.15 billion.

During the first quarter of 2018 more than $7.4 billion were collected. The two largest projects of 2018 are the TON ICO and the Petro ICO, which collected record amounts during their presales and, in so doing, opened completely new possibilities for development of blockchain technology and possibilities for ICOs.

Anex – Glossary

| Key terms | Definition |

| Initial coin offering, ICO | A form of collective support of innovative technological projects, a type of presale and attracting of new backers through initial coin offerings (token sales) to future holders in the form of blockchain-based cryptocurrencies and digital assets. |

| Token sale price

Current token price |

Token sale price during the ICO.

Current token price. |

| Token reward | Token performance (current token price ÷ token sale price during the ICO), i.e. the reward per $1 spent on buying tokens. |

| Token return | (see token reward) Performance of funds spent on buying tokens or the ratio of the current token price to the token sale price, i.e. performance of $1 spent on buying tokens during the token sale, if listed on an exchange for USD. |

| ETH reward – current dollar value of $1 spent on buying tokens during the token sale | Alternative performance indicator of funds spent on buying tokens during the ICO or the ratio of the current ETH price to its price at the start of the token sale, i.e. if instead of buying tokens $1 was spent on buying ETH at its rate at the start of the token sale and then it was sold at the current ETH price. |

| BTC reward– current dollar value of $1 spent on buying tokens during the token sale | Similar to the above: Alternative performance indicator of funds spent on buying tokens during the token sale, i.e. if instead of buying tokens $1 was spent on buying BTC at its price at the start of the token sale and then it was sold at the current BTC price. |

| Token/ETH reward | This ratio describes a market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying ETH. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on ETH. |

| Token/BTC reward | This ratio describes the market participant’s economic benefits and disadvantages resulting from buying tokens during the token sale relative to buying BTC. If the result is over 1, the market participant spent his funds more efficiently on buying tokens than if he were to have spent his funds on BTC. |

The post Quarterly ICO Market Analysis [Q1 2018] appeared first on CoinSpeaker.